Long before anyone had heard of COVID-19, there was already a growing retirement crisis in America. It’s well documented that too many U.S. workers struggle to save enough to fund a comfortable retirement. For example, a 2020 Vanguard analysis reports the average 401(k) balance is $101,771. The median balance — which is more representative of what most Americans have saved — is less than $26,000. And now, in the pandemic year of 2020, economic and healthcare trends threaten to widen the financial gap faced by underfunded retirement savers and retirees.

To gauge how Americans are feeling about retirement, generally and in light of COVID-19, and to assess knowledge about life insurance and life settlements, Harbor Life Settlements conducted a nationwide survey of 1,700 U.S. adults across four generations. The data revealed a mix of attitudes, ranging from retirement confidence among certain groups to high levels of concern about the long-term financial impacts of COVID-19. There are also generational differences in how individuals plan to fund their retirement and in the retirement expenses savers are most worried about.

Retirement preparedness varies across demographics

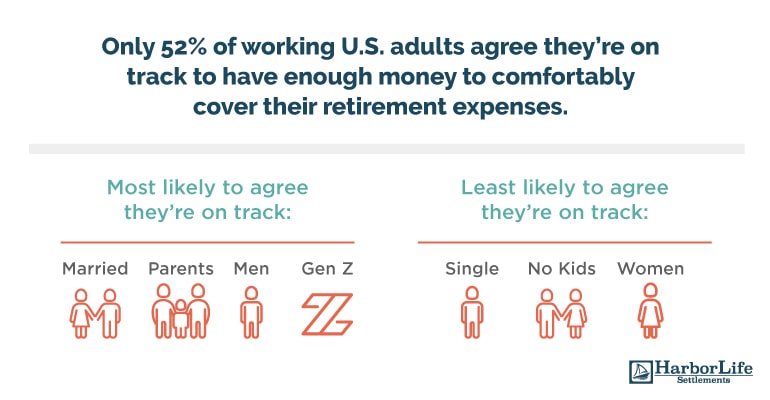

Among pre-retirees, retirement preparedness is split almost down the middle. Roughly half of working U.S. adults (52%) agree that they’re on track to have enough money to comfortably cover their medical, living, and retirement expenses after they leave the workforce. The unfortunate flipside is that more than one-fourth (28%) of non-retired Americans do not agree that they’re on track for a comfortable retirement.

Current retirees, on the other hand, are far more confident in the state of their finances. More than three-quarters (76%) of retirees believe they do have enough money to cover their medical, living, and retirement expenses. This high confidence level is partially driven by early retirees, however, who may not represent the norm. Drilling down to retired seniors specifically, only 60% agree that they are sufficiently funded to cover their expenses in retirement. That compares to 96% of retired Generation Xers and 91% of retired Millennials who feel confident in their finances. These discrepancies likely indicate that most non-senior retirees choose early retirement precisely because they can afford it — rather than being forced into early retirement due to health issues.

Younger savers recognize the advantage of time

Generationally, younger working adults are more likely to feel they’re on track to save enough for retirement. Fifty-six percent of workers between the ages of 18 and 25 feel confident in their retirement savings momentum, for example. That compares to 51% of working adults over the age of 25. Younger workers who’ve already started saving for retirement are right to feel confident. They have the advantage of time, which is easy to quantify. As an example, a $500 monthly contribution saved for 40 years will grow to more than $1.3 million when invested at a 7% rate of return. But a $1,000 monthly contribution saved for 20 years, which amounts to the same out-of-pocket cost, only grows to about $520,000.

Married couples, spouses more confident

The size of one’s household also influences confidence around retirement preparedness. Married adults, for example, are more likely to feel good about their retirement prospects than single adults. This makes sense; a married couple has the opportunity to benefit from two incomes, two sets of employer-matching contributions, and two Social Security benefits. Married adults who aren’t retired are 70% more likely than single adults to say they’re on track to have enough money to cover their expenses in retirement. And, 84% of married, retired adults continue to believe they have enough money. By comparison, only 49% of retired single adults say they have enough to cover their medical, living, and retirement expenses.

Also, working parents are 38% more likely than working adults without kids at home to feel they’re on track financially for retirement. That’s an unexpected datapoint, because working parents should have higher living expenses than non-parents. Parents may also take on the burden of college tuition for their children, which can be a sizable pre-retirement expense. Even so, working adults without kids are 84% more likely than working parents to feel they’re not on pace to fund a comfortable lifestyle in retirement.

COVID-19 strains retirement preparedness

COVID-19 has dealt a series of blows to the U.S. economy and retirement savers. The financial markets crashed in March, and then recovered so quickly that some analysts are worried about a second major dip ahead. Unemployment spiked to 14.7% before moderating back to 7.9% in October. That recovery is a good thing, but the current unemployment rate is still more than double the February benchmark of 3.5%. And bond yields are at all-time lows — a circumstance that’s particularly tough on retirees, since they lean on U.S. Treasury bonds over riskier stock market positions for capital preservation and income.

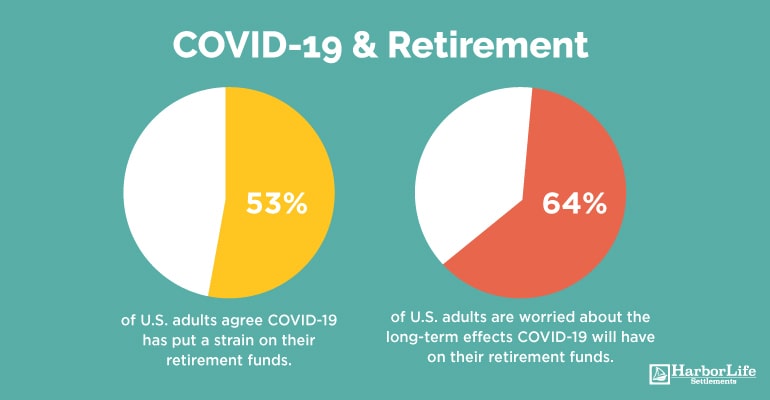

Given those factors, it’s not surprising that 53% of U.S. adults agree that COVID-19 has already put a strain on their retirement funds. What is surprising is that the individuals in this group are more likely to be younger — while older adults are more likely to believe the pandemic has not strained their retirement funds. For example:

- Seniors are 30% more likely to say they do not agree COVID-19 has put a strain on their retirement funds when compared to non-seniors.

- Adults over the age of 41 are 23% more likely to say they do not agree COVID-19 has put a strain on their retirement funds, when compared to adults 40 and younger.

One factor that may play into these different attitudes is the uneven nature of pandemic-fueled unemployment. Data from Pew Research indicates that individuals aged 16-34 experienced higher unemployment rates related to COVID-19 vs. older age groups. That may be contributing to the financial strain felt by younger adults related to COVID-19. Unemployment obviously creates a range of problems for retirement savers. They lose the ability to contribute to their retirement accounts, they may be more likely to withdraw funds from retirement accounts, and they can potentially rack up debt that makes it more difficult to save for years to come.

Married couples, parents are worried

While married couples and parents have a higher level of confidence in their progress towards being financially prepared for retirement, they’re also more concerned about the effects of COVID-19. That could be a consequence of simply having more to lose. Fifty-eight percent of married adults agree that the novel coronavirus has already affected the assets they had earmarked for retirement, compared to 45% of single adults. As well, more than two-thirds (67%) of married U.S. adults are worried about the long-term effects COVID-19 will have on their retirement funds. But only 59% of single adults share that worry.

Parents are 45% more likely than non-parents to feel that COVID-19 has already strained their retirement funds. And a full 72% of those with kids admitted their concerns about the long-term impact the pandemic will have on their retirement assets. That compares to only 57% of non-parents. Non-parents tend to have a decidedly more relaxed outlook on how COVID-19 influences their retirement plans; they’re 92% more likely than parents not to be worried about how the pandemic ultimately affects their retirement savings.

Retirees are affected by COVID-19

While older adults feel relatively less stress than younger adults with respect to COVID-19 and retirement, that dynamic is more characteristic of working older adults vs. retirees. Retirees are definitely feeling the burden of COVID-19 on their finances. Seven of 10 retired U.S. adults said COVID-19 has strained their finances and 76% of retirees are worried about the long-term financial impacts of COVID-19 on their retirement funds. Working adults, on the other hand, are twice as likely than retirees to be unconcerned with long-term financial impacts of the coronavirus.

Social Security remains top source of retirement funding

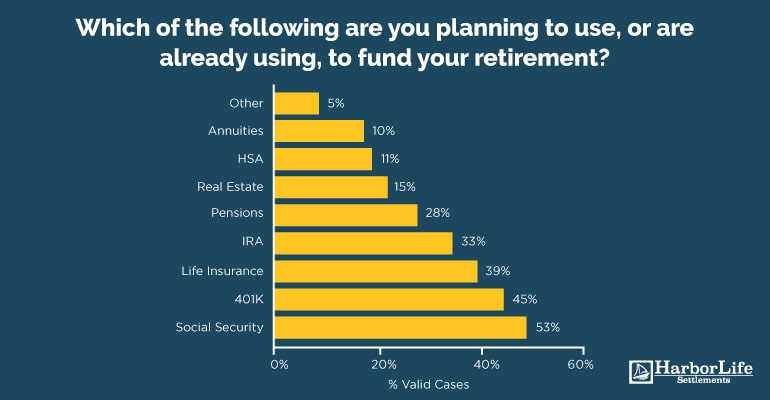

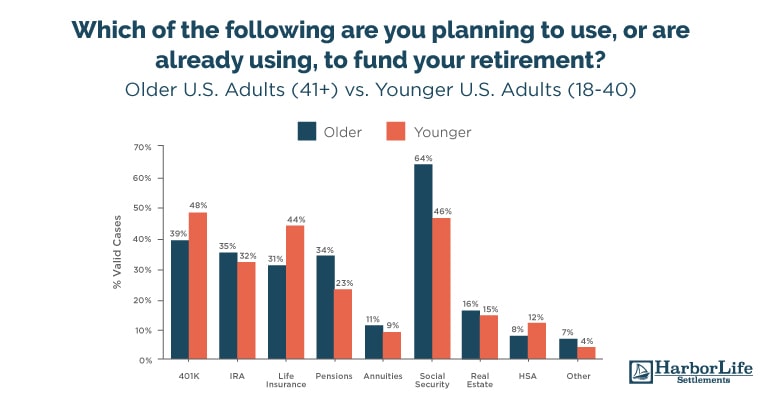

When looking at our data around retirement funding, current and future retirees rely heavily on Social Security as a source of income after they leave the workforce. More than half (53%) of U.S. adults are either using Social Security or intend to use Social Security to fund their retirement. That makes the federal retirement benefit a more popular source of retirement income than 401k savings (45%), life insurance (39%), IRA savings (33%), or pensions (28%).

The reliance on Social Security does skew towards older adults, which is understandable given Social Security’s uncertain future. The most recent projections from the Social Security Trustees Report show that if no changes are made to the Social Security system, benefits will have to be reduced in 2035 as program expenses outpace income. That means today’s Generation Zer and Millennial may face dramatically different levels of benefits from Social Security relative to what the current generation of retirees has enjoyed. These younger adults, specifically aged 40 and younger, expect to fund retirement primarily with 401k balances (48%). Social Security was the second-most popular choice, selected by 46%, followed by life insurance, a chosen funding source for 44% of younger adults.

Adults over the age of 40 have a different outlook. Sixty-four percent are banking on Social Security, 39% on 401ks, and 35% on IRAs. Interestingly, life insurance was not a top-three funding source for these older adults, though it was a popular choice for Gen Zers and Millennials.

HSAs may be underused

Annuities, real estate, and Health Savings Accounts (HSAs) were the least popular funding sources for retirement, across all age groups. It’s somewhat surprising that HSAs aren’t more popular among retirement savers, given that the current rate of healthcare inflation is 4.2% — more than double what would be considered normal inflation for consumer prices. Some studies predict that a couple retiring this year could spend upwards of $290,000 cumulatively on healthcare expenses. The HSA can make that burden more manageable, since it’s the only financial vehicle that offers a triple tax benefit: tax-deductible contributions, tax-deferred earnings, and tax-free withdrawals when the money is used to cover medical costs.

Life insurance popular among parents, spouses, and retirees

Life insurance as a source of retirement funding appeals to families as well as younger adults. Nearly half (49%) of married adults selected life insurance as a source of retirement income, compared to 23% of single adults. Parents, too, feel optimistic about using their life insurance to fund retirement — more so than Social Security. Some 56% of parents chose life insurance as a retirement funding source, while only 44% selected Social Security and 40% selected 401k. By comparison, only 25% of adults without children plan to use their life insurance to help fund retirement.

Retired U.S. adults are also more inclined to tap their life insurance for retirement income. Forty-six percent of retirees selected life insurance as a funding source, compared to 37% of working adults.

Medical, housing costs are top concerns

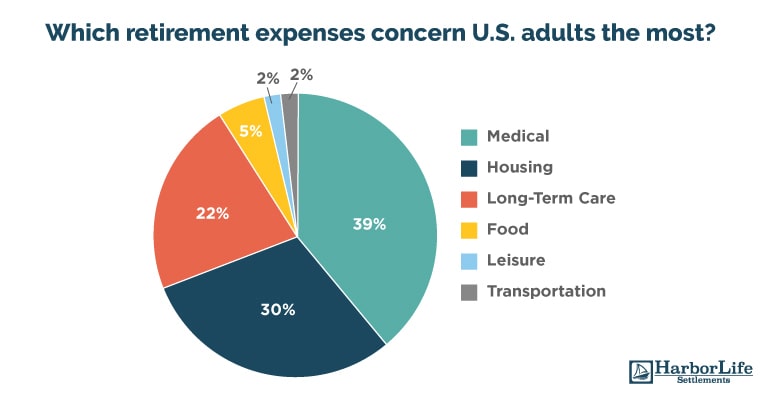

Current and future retirees are most concerned with medical, housing, and long-term care expenses in retirement. Specifically, when asked, “which retirement expense concerns you the most,” respondents across all demographics answered as follows:

- Medical expenses (39%)

- Housing costs (30%)

- Long-term care costs (22%)

- Food (5%)

- Leisure (2%)

- Transportation (2%)

Among adults without children at home and single adults, housing shifts into the top spot as the most worrisome expense in retirement. Nearly one-third (32%) of non-parents selected housing as their top concern, compared to 26% of adults with children. And 38% of unmarried adults said they were most concerned about housing, vs. only 24% of married adults.

Medical expenses are a top worry across the board, but they’re more of a concern among non-retired U.S. adults than retirees. Forty percent of non-retired adults selected medical expenses as their most pressing concern, compared to only 34% of retirees.

The separate healthcare category of long-term care costs, however, does weigh on the minds of seniors as well as married adults. Seniors are 50% more likely than non-seniors to be most concerned about the cost of long-term care; 30% of seniors selected long-term care as their top concern vs. 20% of non-seniors. And married adults are 39% more likely than single adults to view long-term care costs as their most concerning retirement expense. A quarter (25%) of married adults expressed concern about long-term care, relative to only 18% of single adults.

Food expenses are not a top concern among any age group, though some trends do emerge among specific demographics. Parents, for example, are twice as likely than single adults to be mostly concerned about the cost of food in retirement. And retired adults are 75% more likely than working adults to identify food as the retirement expense they’re most worried about. Retired adults are also 150% more likely than working adults to worry most about the cost of transportation in retirement.

A blurry retirement outlook

Top-level data from Harbor Life Settlement’s 2020 Life Settlement and Retirement Survey shows both confidence and insecurity among U.S. adults with respect to their retirement outlook. A deeper look at the views on retirement preparedness across demographic groups reveals even more contrasts. Medical costs in retirement are a top concern for 39% of Americans, yet only 11% of U.S. adults expect to use a tax-advantaged HSA to fund their retirement expenses. Life insurance is far more popular as a source of retirement income than the HSA, but its popularity skews heavily towards parents, spouses, and retirees. And, Americans across the board are largely dependent on Social Security in retirement even as the federal program has a well-documented funding issue on the horizon.

One attitude that is fairly consistent, though, has to do with the financial consequences of the pandemic. A majority of retired Americans, married adults, and parents are worried about the long-term impacts of COVID-19 on their retirement funds. Given that the pandemic is still raging on without an endpoint in sight, those long-term consequences may remain unknown for the foreseeable future.

About Harbor Life Settlement’s 2020 Life Settlement and Retirement Survey

The findings presented in this article are the result of a study of 1,702 adults, aged 18 and over, conducted by Harbor Life Settlements in August, 2020. Confidence level: 95%. Margin of error: 2.5%.

Survey respondents include parents, meaning those with children under the age of 18 living in their household, along with seniors, Generation Xers, Millennials, and Generation Zers, defined as follows:

- Seniors, age 55 and older

- Generation X, age 41 to 54

- Millennials, age 26 to 40

- Generation Z, age 18 to 25