2025 Life Settlements Industry Report

Check out our Life Settlement Report to learn about the current Standing and Future Potential of the Life Settlement Market

Home » 2025 Life Settlements Industry Report

*Note: This Life Settlement Report was previously published in 2022, but has been updated with more recent data in select places throughout the report.

American Seniors Are Losing Billions Every Year, Here’s How the Financial Industry Can Help

Each year, some $200 billion in life insurance will lapse or be surrendered that could have been sold on the secondary market instead1. Two hundred billion dollars is a staggering amount of wasted wealth, particularly in a country that’s facing an epic financial crisis for it’s senior population.

Luckily, dramatic advancements in technology and industry have opened up what can be a new era in life settlements to solve this multibillion dollar problem. Roughly 10,000 people in the U.S. reach their 65th birthday every day, according to the United States Census Bureau2 — a demographic trend known as the “silver wave.” By 2050, the number of seniors in the U.S. is projected to exceed 88 million and account for more than 20% of the population3.

Unfortunately, that ballooning older population is facing extreme financial headwinds. Study after study has documented insufficient retirement funding for many of these older savers. At the same time, the safety nets of Social Security and Medicare are becoming less reliable as their respective trust funds approach insolvency over the next 15 years.

Given these trends, seniors should be capitalizing on every penny of value tied up in their assets, including life insurance. However, many seniors and people in general don’t realize their life insurance policy is an asset that can help with retirement.

A lot of people with life insurance don’t value it as an asset, they think of it as a lease

Anonymous Life Insurance Sales Rep

For many, the perceived value of life insurance is the death benefit which can act as a financial safety net for loved ones in the case of accidental death. However, almost 90% of all life insurance policies will be lapsed or surrendered without paying the death benefit1, which means money is being left on the table.

An insurance lapse returns nothing to the policyholder. And a life insurance surrender returns only a minimum amount of cash relative to premiums invested. Seniors can usually generate far more funding by selling those unwanted policies on the secondary market in a life settlement. Life settlements can command sales prices that are 4-11 times higher than the policy’s surrender value, or up to 60% of the death benefit4.

Interested In Life Settlements?

Life settlements are an underutilized option among policyholders and financial professionals. If you’re interested in a life settlement for yourself or your clients, get started by contacting us today for more information.

I'm A Policyholder

Have a life insurance policy you no longer want? Don’t surrender or lapse your policy, find out if you’re eligible to sell it through a life settlement, and get a FREE no-obligation estimate of how much your policy is worth.

I'm A Financial Professional

Find out if your clients are eligible to sell their policies through a life settlement, how much their policies are worth, and learn about our partner’s Life Settlement Advisor program—an invaluable resource to help advisors better serve their senior clients.

Table of Contents

Why Aren’t Seniors Utilizing Life Settlements?

Seniors aren’t taking advantage of life settlements as much as they could — and it’s not their fault. The life settlement industry is facing several challenges that hold back its growth. This is hurting policyholders, and limiting investment opportunity in an underutilized asset class.

However, hope is on the horizon — advances in technology and changes to industry standards are about to pave the way for life settlements to take off at an unprecedented pace. These changes are already happening, but before we discuss how they’re about to change the life settlement market — we’ll begin by providing insight into the factors that have held back life settlements in the past.

1. Lack of awareness that policies can be sold

The largest factor in the underutilization of life settlements is a lack of awareness that this option exists. A 2010 survey by the Insurance Studies Institute found that 90% of seniors who have let a policy lapse would have considered selling it if they had known about life settlements5. That is to say, most people don’t know their life insurance policy has a secondary market value and can be sold, in some cases for a value greater than their house.

These policyholders are at a higher risk for lapsing or surrendering their policies for less than they’re worth because they don’t know that policies are a sellable asset.

Awareness among personal finance professionals is higher, but acceptance among financial advisors and broker-dealers is lower than it should be. Many advisors and brokers don’t fully understand life settlements and are resistant to learn. The resistance may come from lingering, but inaccurate perceptions that life settlements are illegal or fraudulent.

Moving forward, awareness of life settlements is expected to increase as the upcoming “silver wave” of Baby Boomers looks for ways to help fund retirement. In fact, research estimates the annual gross market potential for life settlements will be $212 billion from 2019 to 20281.

2. A long, complicated process

It sounds, to me, more complicated than selling your house. It’s a long process. That’s another problem.

Donna Horowitz, Senior Editor, The Life Settlements Report

Selling a life insurance policy can take months. A life insurance surrender, on the other hand, takes days. Depending on the policyholder’s financial situation, the faster timeline of a surrender could be appealing — even if it means liquidating the insurance for much lower proceeds. However, new advances in AI and underwriting are paving the way to make the settlement process faster and more efficient. As this technology gets better, the life settlement process should take less time enabling policyholders to quickly get money for their cases.

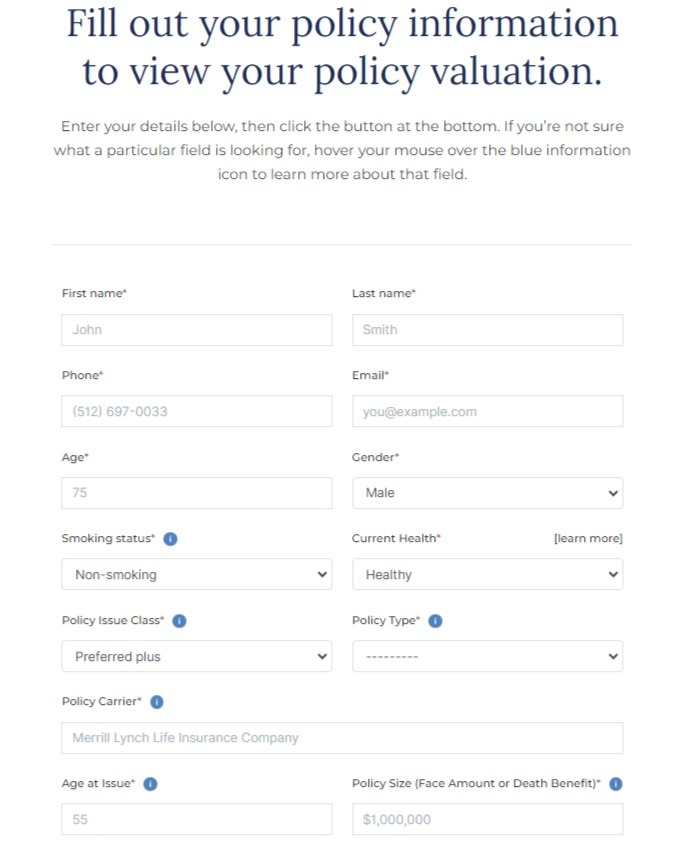

As an example, Advisors can upload a policy for rapid review by our team of life settlement experts who utilize proprietary technology and data to provide a free policy valuation, and in some cases, a nearly immediate offer. This can help shorten the time it takes your client to turn their expensive policy into cash in the bank.

3. Inconsistent standards for advisors

Registered investment advisors or RIAs are held to the fiduciary standard, meaning they must always prioritize their clients’ best interests. In scenarios where a life settlement is potentially a client’s most lucrative solution, fiduciary duty should require an RIA to introduce the concept.

Unfortunately, conflicts can arise for RIAs who work for broker-dealers. Broker-dealers are not held to the fiduciary standard; instead, they must follow the more lenient “best interest” standard defined in Regulation Best Interest (Reg BI). In practice, broker-dealers may prohibit their RIAs from discussing or facilitating life settlements which creates a legal gray area that can result in situations where a life settlement should be recommended, but isn’t.

Moving forward, as life settlements become more popular it’s likely there will be a strong push for equal standards between these parties. If a life settlement is in someone’s best interest, their advisor or agent should be required to inform them of this option. The SEC attempted to address this issue in 2019 with the Reg BI rule, but many argue that while it was a step in the right direction — the policy needs to be expanded in order to cover assets that aren’t a security.

4. Life insurance companies discourage agents from doing settlements while they secretly do it themselves

In some cases where a policyholder expresses interest in pursuing a life settlement, their life insurance carrier may discourage them from doing so in favor of surrendering the policy. In these situations, life insurance carriers may ask policyholders to halt the life settlement process and provide a limited-time offer significantly higher than the normal cash surrender value of the policy.

Some insurance carriers are going a step further by proactively reaching out to elderly or sick policyholders and offering to buy out policies through a process that mimics a life settlement, but with an offer that is significantly lower than what the policyholder would be able to get on the free market. For example, two prominent insurance companies used the following marketing language to encourage people to sell their policy to back to the carrier7:

- John Hancock: “We would like to offer you an option that might better align with your current financial needs. Like many of our customers, you purchased your life insurance policy with a specific financial goal in mind. What fit your needs and met your goals at that time, may no longer work for you.”

- Lincoln National: “Here are some circumstances that could prompt a review of your financial plan and life insurance coverage: Changing family needs, marriage, divorce, or family member care. Health considerations – a need for benefits that address health related expenses. Market or policy changes – your current financial situation has changed since purchasing this policy… Career changes – a new business development or shift in leadership.”

The idea is to try and get people to surrender or sell their policy back to the insurance company instead of a third party so the insurance company never has to pay out a death benefit. This isn’t a radical idea, it’s how the entire insurance industry operates. Insurance companies work under the assumption that most of their policyholders will never file a significant claim — such as their house burning down, developing a life-threatening medical condition, or collecting a death benefit after a lifetime of continuous payments. If every policyholder filed a claim of this proportion, these companies would not make a profit.

So, when a life insurance carrier offers to buy out their client’s policy, it’s not because they think it’s in the client’s best interest — it’s a last ditch effort to

minimize their losses.

These practices discourage legitimate life settlements and are highly unethical and even illegal in some cases. These offers by carriers violate statutes that regulate insurers, such as the “Smoothness Test” of standard nonforfeiture law that7:

- Requires a “reasonably orderly sequence of increases in the actual cash value”

- Requires “consistency of progression of cash surrender values”

- Prohibits “sharp increases” in cash surrender value and “benefits available only during certain windows of time”

Furthermore, these offers by insurers also evade statutes that regulate life settlement companies, including rules that require rescission periods and disclosure of alternatives and compensation. As a result of insurers violating these statutes, some regulators have fined carriers. For example, Lincoln National was fined by several state regulators and has since stopped these practices in those states7. However, some insurance carriers are continuing these practices that restrict consumers from getting fair market value for their policy.

As noted earlier, in many cases a life settlement can provide a return that is 4-11 times higher than the cash surrender value from the insurance carrier4. Even if the insurance carrier increases their cash surrender value, policyholders should still take their policy to the free market in order to see if someone else would pay more for it.

As awareness of life settlements increases, consumer knowledge of these unethical practices should also grow. However, the best way to protect consumers will be through legislation that prevents life insurance carriers from using these tactics to restrict life settlements.

How Technological Advances and Changes to Industry Standards Are Helping to Solve issues With Life Settlements

While life settlements are currently being underutilized, we believe that advances in technology and industry standards will help solve many of the issues noted above.

Technological advances will help automate and streamline aspects of the life settlement process to make it faster with fewer fees and more transparency. Technology will also play a pivotal role in helping families take a proactive approach to their decision on whether to sell, lapse, or keep a life policy by illuminating previously hidden information that has historically been obfuscated to benefit insurance companies instead of families.

Harbor Life has developed an AI driven algorithm called My Policy Predictor that drastically cuts down the life settlement policy valuation process to help consumers, agents, and financial advisors instantly predict the value of a policy on the secondary market. Using AI and machine learning, people can provide a few basic details about their policy and instantly get a realistic range estimate that’s up to 89.2% accurate. This is a major technological breakthrough because it reduces the time of initial underwriting from 1-3 months down to 1 minute.

By comparison, most similar life settlement calculators give a broad range estimate such as “between $50,000 – $400,000” with the main purpose of showing enticing and often unrealistic offers to generate leads. We believe that people have a fundamental right to know the value of their assets so they can make the best decisions for their families and that technology like My Policy Predictor paves the way to that future.

Unlike other tools that over promise with unrealistic figures to increase leads, we use a market-driven approach built on big data to provide more accurate estimates. To do this, our algorithm analyzes millions of data points from our entire library of cases in order to show real market value including expected commission for agents.

Much like how the MLS system in real estate allowed a seller to get their property in front of every buyer in the market, our life settlement auction platform amplifies a seller’s reach to increase competition and find a true market value. By leveraging our technology, policies can be put in front of every institutional buyer in the world — which increases competition resulting in more bids and higher offers than what is possible through the regular process. This technology also adds transparency, as policyholders can see how many buyers looked at their policy and how many offers were made. Changes in industry standards will also help with these issues, as equal standards for RIAs, financial advisors, and broker-dealers will ensure this option must be presented when it benefits clients.

Considering that 90% of life insurance policies will be lapsed or surrendered without paying the death benefit1, it is imperative that the finance industry and consumers utilize this option more than they currently are to prevent the unnecessary loss of billions each year.

The Looming Retirement Crisis

The American senior population is exploding. Millions of individuals nearing retirement age do not have funding to cover their living expenses after they leave the workforce.

Nearly one-quarter of Americans say they never plan to retire.

Andrew Soergel, Writer, Associated Press8

Beyond living expenses, about 70% of seniors will also have to pay for long-term care. Today, those services cost $4,500 to $8,000 monthly. By 2030, long-term care costs will rise to a range of $6,000 to $12,000 monthly, according to insurance company Genworth9. The low-end of those ranges pays for full-time homemakers. The high-end represents estimated costs for a private room in a nursing home9.

Unlocking Billions for Retirement Funding

The financial services industry, not the government, is best positioned to solve this looming retirement crisis. And life settlements can be central to that solution.

Consider how much additional senior funding would be available if:

- Life settlements were widely accepted as a desirable financial strategy to liquidate life insurance.

- Every senior compared the value of their life insurance on the secondary market to the policy’s surrender value — prior to making any decisions to terminate coverage.

- Senior policyholders could sell their life insurance with confidence that they’d have full transparency into the transaction.

- Financial advisors, insurance agents, RIAs, and broker-dealers are obligated to objectively evaluate whether a life settlement makes sense for their clients

If the life settlement industry can evolve and improve to reach mass adoption, seniors with life insurance could unlock billions to fund their retirement.

This industry evolution will have to include:

- Quicker valuations on life insurance, so policyholders know the value of their asset.

- Greater acceptance of life settlements among financial professionals and advisors, as well as broader recognition that life insurance is a valuable asset in retirement planning.

- More transparency so policyholders understand how their policies are being marketed, to whom, and who’s earning commission on the sale.

The shift to greater transparency and broader acceptance of life settlements is already happening. The future of life settlements relies on a fully transparent transaction process. That’s the best step the industry can make to break away from its past and achieve mass adoption.

The future of life settlements relies on a fully transparent transaction process. That’s the best step the industry can make to break away from its past and achieve mass adoption.

Life Settlements Industry Report Preview

Too many seniors in the U.S. today are edging towards financial ruin. They’re under-funded and reliant on government programs to keep them out of poverty in their senior years.

Those government programs — Social Security, Medicare, and Medicaid — are not sustainable in their current form. Without major legislative action, millions of retirees will see their Social Security and Medicare benefits cut by double-digit percentages in the next 15 years. Medicaid’s funding model is more solid, but that program too could break under the weight of a rapidly aging population.

Greater adoption of life settlements could ease this impending crisis. That’s why life settlement professionals have a responsibility to clean up their industry. The livelihood of seniors around the country depends on it.

To understand where the life settlement industry is today, it helps to look at its past. Next is a brief history of life settlements, plus an overview of how these transactions work and real-life examples of life settlement outcomes. That section is followed by a deeper look at where the industry is faltering, and why now is the time for evolution and growth.

History of Life Settlements

The U.S. Supreme Court validated the legality of life settlements in the early-1900s10. The case was Grisgby v. Russell, and the policy in question was formerly owned by a man named John C. Burchard. Burchard needed a medical procedure he couldn’t afford, so he sold his life insurance policy to his physician, Dr. Grigsby. Grigsby subsequently paid the premiums and kept the policy in force through the remainder of Burchard’s life.

When Burchard later passed away, the executor of the Burchard estate contested the death benefit payout to Grigsby. The Supreme Court ruled in Grigsby’s favor, arguing that life insurance is private property and can legally be sold by its owner.

Notably, Associate Justice of the Supreme Court Oliver Wendell Holmes Jr. said:

So far as reasonable safety permits, it is desirable to give to life policies the ordinary characteristics of property. To deny the right to sell except to persons having such an interest is to diminish appreciably the value of the contract in the owner’s hands.

Oliver Wendell Holmes Jr., Associate Justice of the Supreme Court of the United States

The Rise of Viatical Settlements in the 1980s

Decades later, a secondary market for life insurance would develop out of necessity, using Grigsby v. Russell as the legal precedent. This happened in the 1980s as the AIDS crisis gained momentum.

At that time, an AIDS diagnosis was terminal. Only experimental treatments were available, and they were expensive. The primary treatment was AZT (azidothymidine), and it cost about $16,500 a year in today’s dollars11. Many patients, especially those who were unable to work, desperately needed a funding source for treatment.

The epidemic set a stage for rapid growth in viatical settlements, which are life insurance sales for terminally ill policyholders. Brokers marketed viatical settlements almost exclusively to people living with AIDS. The market was large. In the early 1990s, HIV was the leading killer of Americans aged 25 to 4411.

The viatical settlement industry grew quickly as a result, but there were growing pains. These transactions were unregulated, which allowed space for unethical players to operate. Sadly, too many individuals with AIDS were taken advantage of. Among surviving friends and family, viaticals developed a negative reputation.

HIV/AIDS treatment would soon evolve to a combination of protease inhibitors with AZT. That treatment protocol improved lifespan and life quality for individuals living with the deadly disease. As a result, viatical settlement activity declined in the 1990s. Life settlements subsequently began to grow in popularity.

Life Settlement Regulations

The momentum in life settlements caught the attention of state regulators in the late 1990s. The industry has since been shaped by state regulations as well as:

- The Life Settlements Model Act, adopted by the National Conference of Insurance Regulators (NCOIL) in 2000. The act lays out requirements for contracts, disclosures, and reporting. It also specifies licensing requirements for agents and providers and describes prohibited business practices.

- The Life Insurance Consumer Disclosure Model Act, adopted by NCOIL in 2010, which mandates written disclosures to seniors in danger of policy lapse.

- Tax Cuts and Jobs Act, signed into law in 2017, which defined a more favorable tax treatment for life settlements.

- State-imposed waiting periods and disclosure laws. Eight states require life insurers to tell policyowners about life settlements before they surrender or lapse their policy. Thirty-three states have waiting periods, meaning a policy must be in force for a minimum duration before it can be sold. A state-mandated waiting period prevents people from buying insurance solely for the purpose of selling it. These waiting periods range from two to five years.

Media Coverage of Life Settlement Investor Fraud

Even as state regulators and industry groups set standards for the life settlement industry, a few notable cases of fraud have put the industry in a bad light. In July of 2016, a bankruptcy judge approved a $1 billion settlement to resolve a class action lawsuit against viatical settlement provider Life Partners12. Life Partners defrauded investors by presenting inaccurate life expectancy data on insureds, which is a key factor in determining a policy’s value to an investor.

Also in 2016, AIG and Coventry settled a lawsuit alleging $160 million in hidden markup and fees on life settlements13. AIG accused Coventry of overcharging for life settlements the company had purchased on behalf of Lavastone Capital LLC, an AIG company.

Unfortunately, these and other widely publicized disputes draw negative attention to life settlements. Given the lawsuits and headlines, it’s understandable that policyholders, investors, and financial services professionals often assume the life settlement industry lacks integrity.

Despite Negative Press, There Are Positives

Meanwhile, there are honest professionals liquidating unwanted policies for seniors regularly. These stories don’t make headlines, unfortunately.

When a life settlement is managed professionally and with transparency, it creates value for all parties. Senior policyholders receive a cash outlay, providers add an asset to their or another investor’s portfolio, and investors generate healthy returns.

Today, the industry moves towards greater adoption and acceptance. That’s being pushed by direct-to-consumer marketing campaigns created by individual industry players, as well as by joint marketing and awareness efforts coming from the Life Insurance Settlement Association (LISA). As The Life Settlements Report’s Senior Editor Donna Horowitz points out, over the years LISA has built awareness through conferences, guest articles, blogs, its website, and advocacy of consumer-awareness bills. And because of these efforts, more policyholders are understanding they can sell their life insurance for maximum value, and they are responding to that value proposition.

However, Horowitz and others in the industry believe more can be done on the awareness side. “Individual marketing campaigns and the work through the trade group LISA have helped make the life settlement more well known than it used to be, but there is still room to grow. Life settlements are not a household name yet.” Horowitz believes the life settlement market could take a page from the reverse mortgage market and join forces on an even larger scale to generate awareness. A bigger, collaborative marketing effort with more industry players and consistent messaging could create more value for life settlement brokers, providers, advisors, and underfunded senior policyholders.

Life Settlement Process Overview

Few people are aware of what a life settlement is, and even fewer have an understanding of how they work. A common question among advisors and policyholders is: How long does it take to sell life insurance in a life settlement? Usually, the process spans two to four months, as the policy moves through nine steps from application to completion.

1. Application. To start the process, the policyholder completes an application with a life settlement company or provider. The application collects details about the insured and the policy, including the insured’s age and policy’s size, type, premiums, and cash value.

2. Documentation. The insured also signs medical releases and provides contact information for health care providers. The life settlement company then works behind the scenes to gather medical records that verify the insured’s health.

3. Review and underwriting. In this phase, the life settlement company verifies the insured’s medical history is complete. The health information is forwarded to a medical underwriter who prepares a life expectancy report or lifespan estimate. Estimated lifespan is a critical factor in the market value of a policy. Therefore, the underwriter’s report becomes part of the case file, viewable by prospective buyers.

4. Offer. After the policy is underwritten, the life settlement company will identify which buyer or buyers they work with would be most interested in purchasing the policy. The policy is presented to potential buyers, and offers to purchase it are provided to the life settlement company.

5. Closing package. After the policyholder accepts an offer, the life settlement company assembles the closing documents. These usually include a contract, life expectancy report, insurer verification that the policy is in force, and a letter of competency. The letter of competency is a physician-signed document verifying that the policyholder is of sound mind, capable of making financial decisions. The closing package may differ slightly, depending on the state where the policyholder lives.

6. Notification. The life settlement company notifies the insurance company that the policy has a new owner and beneficiary. The insurer reviews and verifies the documentation, makes the changes on the policy, and then notifies all parties that the changes are implemented.

7. Funds transfer. After the policy ownership and beneficiary have been updated, an escrow agent distributes the sale proceeds to the policyholder.

8. Rescission period. A rescission period is a state-defined window when the policyholder can still cancel the transaction. The exact timeline varies by state, but one or two weeks is common. After the rescission period ends, the life settlement is final and cannot be rolled back.

Real Life Settlement Examples

Life settlements have positive outcomes for selling policyholders. Cash-strapped seniors and their families are often thrilled to learn how much wealth is locked up in their life insurance. Plus, selling the policy can be the least intrusive solution to a financial bind — preferable to selling a home or liquidating investments that provide income.

At Harbor Life, our clients share their positive stories every week. Below are a few real-life examples of how a life settlement can generate cash to improve people’s life quality.

1. Improved living situation for a grandmother

A grandmother was living in a subpar nursing home because it was all her family thought they could afford. The family sold the grandmother’s life insurance and moved her into their home, then used the life settlement proceeds to hire a full-time nurse.

2. Funding for medical treatment

An insured diagnosed with breast cancer approached us to sell her policy. She needed the funds to pay her medical expenses and treatment costs. We were able to secure the sale at 60% of the policy’s death benefit so she could afford her treatment.

3. Making the most of limited time

One woman came to us while her husband was in the early stages of dementia. They sold their life insurance policy and used the proceeds to take the trip of a lifetime before his dementia progressed further

4. Using life settlement proceeds to pay off debt

Data from 2024 suggests the average debt in America is $104,215 across mortgages, auto loans, student loans, and credit cards. One couple came to us when they were in significant debt, as they were worried they’d have to sell their house and were looking for alternatives to pay off the debt. Few people realize their life insurance policy is one of their largest assets, and in this case, the couple was able to sell their policy and keep their house.

5. Getting money for a policy someone was about to lapse because it was no longer affordable

In some cases, policyholders may experience life changes that lead to them no longer being able to afford the policy anymore. In one such case, a 58-year-old terminally ill man was no longer able to work and his term level period ended, so his premiums were about to go up drastically. He was going to drop the policy, but saw our ad and sold it for $400,000 instead. With the money, he was able to pay for his living expenses while out of work and put money aside for his children.

Shift Towards Uberisation

Uberisation is the process of accessing value locked in under-utilized assets. The term comes from the rise of ride-sharing company Uber. Uber’s business model revolutionized transportation by leveraging privately owned vehicles and drivers’ free time. Vacation rental marketplace Airbnb also follows that model to create value from empty rooms in people’s homes.

Life insurance is an under-utilized asset. More than 90% of life insurance policies that are terminated each year are either lapsed or surrendered15. And about 80% of those lapses and surrenders return nothing to the policyholder15. Those policyholders who’d qualify for a life settlement are essentially throwing away wealth.

Even if a life settlement isn’t the right fit for someone due to ineligibility or by choice, there are other ways to get money from a policy that people may be unaware of. For example, people with whole life insurance may be able to use their policy as collateral for a loan. Harbor Life’s Whole Life Insurance Loan Program offers a way for policyholders to get out of paying premiums and receive a one-time, tax-free cash payment worth up to 95% of the policy’s cash surrender value. The policyholder can choose to repay the loan or not, as the death benefit will cover the loan balance when they pass away and the remaining death benefit amount will be awarded tax-free to beneficiaries.

The point is, that many people aren’t aware that life insurance is an asset. Lapsing or surrendering should be a last resort, but there are almost certainly other options to get a better return from policies.

I have a client that has five life insurance policies, with no idea what to do with them

Mark Beedenbender, President, Elite Financial Planning & Wealth Management, Inc.

Today, more seniors are looking to their assets for creative ways to generate cash and fund their living expenses. In this regard, life insurance is an easy win — far easier than ride-sharing or managing vacation rentals.

Current State of Social Security, Medicare, and Medicaid

The current and future states of federal “safety net” retirement programs contribute to the funding shortfall seniors are facing.

To start, Social Security, Medicare, and Medicaid are not designed to support a comfortable retirement lifestyle on their own. They’re not even rich enough to keep senior beneficiaries out of poverty. These three government programs provide partial financial protections, intended only to supplement seniors’ personal savings.

Social Security

The average Social Security recipient today receives about $1,907 monthly in retirement benefits16. That’s $22,884 annually, which is not a livable wage.

By comparison, the median annual salary for a U.S. worker aged 55 to 64 is $63,54417, nearly three times higher than the average Social Security benefit. Seniors who haven’t saved and become solely reliant on Social Security are essentially facing a 70% pay cut in retirement.

Medicare

Medicare also provides incomplete support. The government-funded healthcare program only covers hospital stays and outpatient services. Long-term care is excluded.

A study from the AARP concludes that the average Medicare beneficiary paid $6,500 in out-of-pocket medical expenses18. That total would consume about a third of the average retiree’s Social Security benefit. And, based on the way Social Security calculates cost-of-living adjustments (COLAs) for beneficiaries, that percentage of healthcare costs to Social Security income could rise quickly.

The Social Security Administration calculates COLAs from movements in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Critics of this formula say the CPI-W underrepresents how much seniors actually spend on healthcare19. If healthcare inflation is high — as it was through most of 2019 and 2020 — seniors can lose purchasing power with the CPI-W-based COLA20.

Medicaid

Medicaid does cover long-term care costs, but only for impoverished households. The income and asset thresholds to receive Medicaid support are very strict. Many who need long-term care sadly have no better choice than to spend down their assets to qualify.

Often, that spend-down process requires a surrender or lapse of life insurance. This is because selling life insurance in a life settlement can make a senior ineligible for Medicaid. That means too many seniors must therefore choose to give away their life coverage in exchange for Medicaid eligibility.

Outlook for Social Security, Medicare, and Medicaid

Demographic trends and government projections suggest that Social Security, Medicare, and Medicaid benefits may be dramatically cut back within the next 15 years — which unfortunately means the upcoming silver wave of seniors won’t have these programs to help fund their retirement.

Social Security

Social Security pays for benefits for current recipients via payroll deductions from those who still work. In a given year, the income from payroll deductions can be higher or lower than the funding needed to pay that year’s benefits. When the income is higher, the excess goes into the Old-Age and Survivors Insurance (OASI) Trust Fund. When income is lower than expenses, the balance in the OASI Trust Fund covers the gap.

This system has worked for decades, but it’s now close to a breaking point. The latest projections from the Social Security and Medicare Board of Trustees estimate that the OASI Trust Fund reserves will be depleted in 203321.

The rapid depletion of reserve funds is being driven by the silver wave of retirees. Social Security’s second largest population of income-producing workers, Baby Boomers, are moving into beneficiary status. This creates an income dip that coincides with a rise in expenses. Once the trust fund reserves are consumed, Social Security cannot pay out more than it generates in income. Once the trust fund reserves are consumed, Social Security cannot pay out more than it generates in income. In the Social Security Administration’s 2023 Report, they noted “As in prior years, we found that the Social Security and Medicare programs both continue to face significant financing issues.”21.

Medicare

Medicare’s timeline to full depletion of reserves is even shorter than Social Security’s. The same factors are in play. Medicare expenses are on the rise as the U.S. population ages. Between 2010 and 2050, the number of seniors aged 65 and older in the U.S. will double from 40 million to about 84 million3. Given that Medicare per capita spending rises with age, Medicare feels the sting of this trend sharply.

The Hospital Insurance (HI) Fund, which supports Medicare Part A, will be depleted by 2026. Thereafter, Medicare’s income can only pay 91% of expected benefits21.

Medicare’s Supplemental Medical Insurance (SMI) Fund, which pays for Part B and Part D benefits, does have adequate funding at this time — only because the program can adjust beneficiary premiums annually to balance the next year’s budget. Benefits costs, particularly for prescription drugs, are rising rapidly. Those higher costs will translate into higher premiums for beneficiaries and, possibly, higher taxes for workers21.

The future of the Affordable Care Act (ACA) is another factor that can help or hurt Medicare. The ACA has helped reduce Medicare spending. Repealing the act would therefore exacerbate Medicare’s funding shortfall. In 2015, the Congressional Budget Office and the staff of the Joint Committee on Taxation estimated that repealing the ACA would increase federal budget deficits by $137 billion between 2016 and 2025. The change would be mostly related to Medicare spending22.

Medicaid

Medicaid has a more flexible financing structure, with funds coming from state and federal governments. Even with the cost-sharing model, Medicaid is the third largest domestic program in the federal budget23. For states, Medicaid spending also represents a large and growing share of annual spending. In 1990, Medicaid spending consumed about 10% of state budgets. By 2016, that percentage had nearly doubled to almost 20%24.

Given the size of Medicaid spending for federal and state governments, the program is a target for budget cutbacks. This is demonstrated by the resistance to Medicaid expansion at the state level. ACA provides for nationwide expansion of Medicare eligibility. In 2012, however, the Supreme Court ruled that expansion should be optional for states. As of October of 2021, 12 states had not yet adopted Medicaid expansion25.

Medicaid may be pushed to its limits as Baby Boomers age. As noted, 10,000 people will turn 65 every day through 2030. More than two-thirds (70%) of these seniors will need some form of long-term care. A study by Urban Institute for ASPE estimates that only 14% of older adults could afford to pay for nursing home care from their income. Further, seniors who use their savings to fund nursing home care run out of money in 11 months on average26. Once their wealth is depleted, these seniors will likely turn to Medicaid as a funding source26.

Low Retirement Preparedness

The uncertain future for Social Security, Medicare, and Medicaid is exceptionally problematic because so many seniors are short on personal savings. The median retirement savings for workers in their 60s is $202,000, according to a study by Transamerica Center for Retirement Studies27.

Assuming an annual withdrawal rate of 4% as recommended by retirement planners, $202,000 in savings delivers an annual income of $8,080. That’s woefully short of what most U.S. workers need to supplement Social Security and avoid a lifestyle downgrade.

An already low retirement preparedness across the senior population will get much worse if Social Security, Medicare, and Medicaid face benefit cutbacks due to lack of funding.

Underutilization of Life Settlements in the Financial Services Industry

The financial services industry is actively contributing to the brewing retirement crisis in the U.S. Financial advisors, planners, agents, and brokers around the country tell their clients daily that it’s acceptable to lapse or surrender life insurance for less than its market value. That needs to change.

In the aftermath of the mortgage crisis, 4.9% of homeowners in the U.S. were three or more months behind on their mortgage. More than 2% of U.S. properties had foreclosure filings in 2010. The spike in foreclosures made national headlines, for obvious reasons. Some 2.8 million homeowners were at risk of losing a major financial asset, their home, and getting no value in return28.

Foreclosure statistics at that time were troubling to the entire financial community. And yet, the industry turns a blind eye to the greater, ongoing loss of wealth associated with life insurance. As noted, more than 90% of life insurance policies are lapsed or surrendered each year.

As with a mortgage foreclosure, policyholders often receive no cash proceeds from the asset loss — despite having made a sizable, cumulative investment in that asset over time29.

Treat your life insurance like you treat your house. Do an evaluation and see what it’s worth

Anonymous Life Insurance Sales Rep

Surrendering life insurance for pennies on the dollar or lapsing life insurance for nothing is not a financial strategy. It’s a waste of wealth.

The largest broker-dealer investment firms in the country are helping seniors throw away the wealth locked in their life insurance. Merrill Lynch, Wells Fargo, and Morgan Stanley prohibit employees from talking about life settlements to their clients or facilitating life settlements for clients.

Why Life Settlements Are Underutilized

Several factors contribute to the underutilization of life insurance, ranging from lack of knowledge on the part of financial professionals to an overemphasis on the tax efficiency of death benefits.

1. Lack of knowledge

Many insurers and advisors don’t recommend life settlements because it’s an unknown area to them. They haven’t taken the time to demystify the topic, and so they avoid it.

Resistance among financial advisors to learning about life settlements will change if more clients take the issue to court. That’s the approach Larry and Joan Grill took in 201430. The California couple asked their insurance agent for help when their sizable life insurance policies became unaffordable. The agent, representing National Life Insurance Company, failed to disclose the life settlement option and instead recommended a partial surrender.

The lawsuit alleges that National Life Insurance Company directed its agents to conceal the life settlement option from clients. This is not uncommon. Life insurance surrenders are an important source of profits for carriers. If a policy is surrendered, the carrier might pay a small surrender value to the policyholder, but the death benefit is void. If a policy is sold, the carrier retains the obligation to pay the death benefit at some future date.

If carriers continue resisting the growing popularity of life settlements, there will be more lawsuits like Larry Grill et al v. Lincoln National Life Insurance Company.

2. Misconception

Among broker-dealers, there’s a persistent misconception that life settlements are a legal liability. The misconception that life settlements can lead to lawsuits comes from situations in which they should have been recommended, but weren’t. However, firms that don’t read into the situation may just associate life settlements with lawsuits, resulting in internal policies that ban their advisors and RIAs from discussing or facilitating life settlements.

With respect to RIAs, this creates a conflict between the RIA’s fiduciary responsibility to the client and the broker-dealer’s policy.

As shown by the case of Larry Grill and Lincoln National, the policy banning life settlements is legally tenuous. Life settlements have been legal for many years, and they are heavily regulated in most states. This is a scenario where internal policies created due to misconceptions about life settlements are actually what leads to the lawsuits firms are worried about in the first place.

3. Lack of enforcement around fiduciary duty

RIAs (who answer to the SEC) have fiduciary responsibility to their clients, which should ideally require them to recommend life settlements when it makes sense. Broker-dealers and financial advisors are under FINRA’s watch, but do not have a fiduciary responsibility. Instead, they are subject to Reg BI, which is a lesser standard than fiduciary responsibility.

Despite the regulated standards of care, RIAs, brokers-dealers, and financial advisors often fail to introduce life settlements to their clients when it’s appropriate. Due to a jurisdictional gap, there is a legal gray area which convolutes whether this option has to be presented. For example, an RIA may recognize that a life settlement is the best option for their client, but if the broker dealer they work for doesn’t allow life settlements — they may be put in a position where they can’t recommend it.

These violations may go unnoticed, but even when they are discovered there may be no consequences because what’s best for the client could be considered subjective on a case-by-case basis. Furthermore, SEC and FINRA authority only extends over variable life insurance policies, because these are viewed as securities31, 32.

The bottom line is that the two consumer protection watchdogs in the investment industry have no grounds to enforce fiduciary or best interest standards with respect to most life insurance policies.

4. Industry reputation

The life settlement industry has a poor reputation, and it’s not entirely undeserved—particularly due to the early years of viatical settlements, mentioned earlier. Fortunately, as life settlements have become more regulated across the country, they’ve become safer for consumers, too.

Some life settlement companies are committed not only to providing an exceptional experience for consumers, but also to going above and beyond to adhere to both the letter and intent of regulations. This is one of the reasons there virtually no consumer complaints about life settlements, while there are tens of thousands annually about insurance companies. In 2023 alone, the Pennsylvania Insurance Department (PID) received over 14,000 complaints about insurance companies.

There needs to be more transparency and a lot less secrecy in the market.

Donna Horowitz, Senior Editor, The Life Settlements Report

5. Lack of transparency around insurance premiums

Forecasting premiums is a critical step in assessing a policy’s value in a life settlement. Today, those forecasts are an inexact science, because life Insurance companies do not share their data or pricing methodology.

The lack of transparency into insurance premiums adds risk for investors, which ultimately works against policyholders. Where there is uncertainty, the buyer lowers the offer to account for the unknown. This is a fundamental concept in any sales transaction, including a life settlement.

In order to get the insurance company to provide the information I needed to get an estimate, I had to tell them I would go to the state commission

Mark Beedenbender, President, Elite Financial Planning & Wealth Management, Inc.

The uncertainty of future costs can also lengthen the life settlement process, as buyers spend more time evaluating. A longer process can dissuade the policyholder who needs to liquidate right away. Policyholders who can’t get an estimate on the policy’s value immediately may turn to other options.

Harbor Life has invested in artificial intelligence that predicts insurance premiums so life settlement buyers and sellers can more easily predict their future costs. The technology aggregates one of the world’s largest databases of optimized insurance premiums and incorporates predictive analysis to give policyholders, agents, advisors, and investors insight into premiums going forward. The resulting data supports instant quotes on policy value and eases risk for investors while giving sellers a better idea of the costs they’d spend maintaining the policy over time.

6. Over-emphasis of death benefit’s tax efficiency

Selling policyholders normally pay taxes on part of their life settlement proceeds. Policyholders and advisors often view that taxability as a negative, especially when compared to the tax-free nature of the policy’s death benefit. This is an understandable comparison, but not necessarily a fair one.

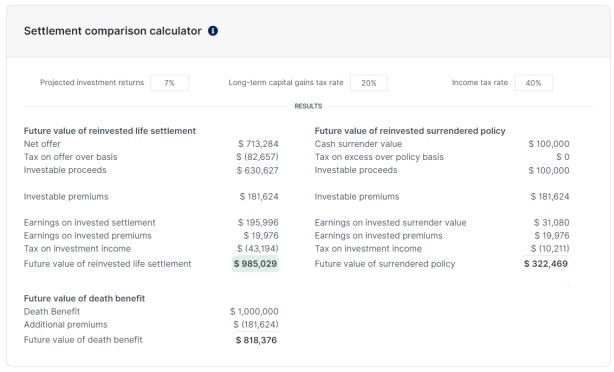

Often, a life settlement can generate more wealth than the original insurance policy by way of sound investing and avoidance of premiums. The case study on the following page demonstrates this, assuming a 7% projected investment returns with a 20% long-term capital gains tax rate and 40% income tax rate. All of these numbers can be adjusted based on each user’s applicable figures.

In this example, the subject is a $1 million life insurance policy, who we estimate would get $322,469 from surrendering their policy, $818,376 from keeping the policy and waiting for the death benefit, or $985,029 from a life settlement.

Surrendering the policy would yield only $100,000 cash surrender value, and while you could invest premiums, the future value ($322,469) pales in comparison to the other options. Holding onto your policy would result in a value of $818,376, because you’d lose $181,624 from the death benefit after paying premiums to keep the policy in force over the rest of your life. By comparison, you could sell the policy for $713,284 ($630,627 after tax), then invest that money and your future premium savings to get $985,029 — the highest future value by far.

Not every case works out this way — but many do. It should be an advisor’s obligation to run these scenarios and identify the more lucrative strategy for the client. Our new AI-driven quoting tool can automatically show financial professionals and their clients the pre and post tax implications of a settlement so that families can make the best decision. By using AI to predict future insurance premiums including increases over time, policyholders can save money by selling early instead of sinking money into a policy they may be unable to maintain long-term.

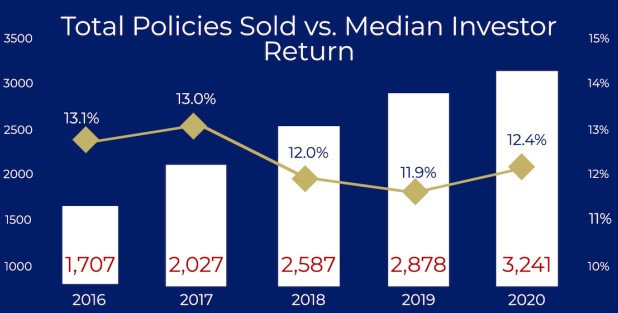

Despite Headwinds, Life Settlements Are Growing

In 2015, life settlement investors purchased just more than 1,000 policies33. As shown in the chart below, life settlement activity has grown steadily, eclipsing 2,000 transactions in 2017 and over 3,000 in 2020.

Supply of Salable Life Insurance Is Increasing

In the years ahead, the same demographic trends that are putting pressure on Social Security and Medicare will contribute to increased life settlement activity. The aging of the massive Baby Boomer population, combined with insufficient retirement savings should surface more seniors who want to liquidate their life insurance. Research company Conning estimates the gross market potential for life settlements between 2019 and 2028 is approximately $212 billion1.

The recent spike in inflation is another factor. Inflation degrades the purchasing power of a death benefit. As an example, the policyholder who bought a $150,000 policy in 1991 might find that benefit insufficient today. In 2021, it takes nearly $306,000 to equal the same purchasing power as $150,000 in 1991.

Inflation often goes unnoticed by the public — until it becomes national news, as it has in 2021. Life settlement activity may increase as more people realize the need to hedge against inflation. For reference, at the current 3% annual inflation rate, the price of goods would double within the next 25 years. That is to say, that someone retiring on a fixed income at age 65 would have half the buying power at age 90.

Cashing out a fixed-benefit policy today and investing the proceeds in asset classes that historically outpace inflation, like equities, could be more beneficial than holding onto the policy and collecting the death benefit, surrendering, or selling at a later point.

Investor Demand is Rising

Economic conditions also have investors looking for alternative assets that are not correlated to the financial markets. The U.S. economy is flush with cash and interest rates are still historically low.

In 2020 and 2021, the U.S. government spent more than $9 trillion on COVID-19 response programs. Actions included $3.6 trillion in purchases of U.S. Treasury and mortgage-backed securities, $1.29 trillion in federal loans, $410 billion in tax-based relief to businesses and households, and $815 billion in direct payments to households33.

Importance of Transparency and Self-Regulation in the Life Settlement Process

Mass adoption of life settlements has sweeping implications. It can unlock hidden wealth to ease the retirement crisis and give policyholders more flexibility to refine their wealth strategy to meet changing needs. To realize those benefits, the industry must embrace transparency.

Regulation

On the regulatory front, Reg BI is not strict enough to uphold the standards the life settlement industry needs.

Firms, brokers, and advisors need to fill the shortfalls of Reg BI by self-regulating to ensure the best outcomes for clients.

Broker-dealers and insurance companies could promote life settlement analysis in cases where the client has excess or unwanted life insurance. It should also be standard practice to regularly evaluate what’s more valuable — a policy’s death benefit or the future value of invested life settlement proceeds? Ignoring that question is a disservice to clients who rely on their advisors for sound financial strategies.

Policyholders should be able to trust all their advisors to provide them with unbiased opinions and individualized solutions. That will help the life settlement industry grow, but it’s also the right approach for the broader financial services industry.

The Bottom-Line Argument

Those who resist transparency in life settlements cite the negative impact on margins. Certainly, buying an asset for $95,000 instead of $385,000 is beneficial to the bottom line in the short-term. Long-term, however, the veiled approach is counterproductive.

According to the Conning report, 61% of policyholders who had lapsed or surrendered life insurance said they were not interested in a life settlement. Those policyholders represent billions in untapped life insurance value — more than enough to support an industry where everyone can profit from lower margins at volume.

That’s far more sustainable for the industry vs. a reliance on higher margins secured through shady business practices. As more adopt this perspective, it will become harder and harder for bad actors to poach policies for as little as possible.

Looking Ahead

The untapped potential of the life settlement market is staggering, but the industry is standing in its own way. To reach that potential, everyone within the industry must prioritize speed, consumer protections, and transparency. That doesn’t happen without adoption of policies and standards that ensure consumers are provided with the respect they deserve.

This includes creating streamlined processes to reduce the length of a life settlement transaction. Thanks to machine learning, AI, and the implementation of other robust technologies, people who work with Harbor Life are able to receive fast, fair offers for their policies.

If the life settlement industry can follow the example of Harbor Life and operate with integrity, the broader financial services industry will take notice. It only benefits broker-dealers, RIAs, financial advisors, and even insurance agents to recognize that life insurance is an asset. Like any other financial asset, a life insurance policy should be evaluated regularly. If the value locked in a life insurance policy could be better deployed in some other form, clients have the right to know.

Future of the Life Settlement Market

With a financial crisis brewing for seniors in the U.S., the elderly need to use their wealth efficiently. No rational-minded person would argue with that conclusion.

And yet, policyholders walk away from $200 billion worth of life insurance every year — often recouping very little (or none) of their cumulative investment in premiums. Worse, many policyholders participate in this waste of wealth under the guidance of an advisor.

Life settlements can redirect lost wealth back into seniors’ pockets. That wealth can offset the lack of savings and benefit cutbacks from Social Security and Medicare.

For that to happen, the life settlement industry must overcome its biggest challenges, including:

- The time it takes to complete a life settlement

- The perception among financial advisors that the life settlement is not a viable financial strategy

- Lack of transparency within the industry

- Absence of equal standards for broker-dealers, financial advisors, and RIAs

References

[1] Conning, Inc. (2019). (rep.). Life Settlements: A Market Takes Off (pp. 43–46). Boston, MA.

[2] America Counts Staff (2019, December 10). By 2030, All Baby Boomers Will Be Age 65 or Older. United States Census Bureau. Retrieved November 8, 2021, from https://www.census.gov/library/stories/2019/12/by-2030-all-baby-boomers-w ill-be-age-65-or-older.html.

[3] Ortman, J. Velkoff, Victoria (2014, May). An Aging Nation: The Older Population in the United States. United States Census Bureau. Retrieved November 8, 2021, from https://www.census.gov/prod/2014pubs/p25-1140.pdf.

[4] Seniors & Retirees Ask Us, “Can I Sell My Life Insurance Policy?” (n.d.). Harbor Life Settlements. Retrieved November 29, 2021, from https://www.harborlifesettlements.com.

[5] Life insurance is a core part of the American financial fabric (n.d.). LISA. Retrieved November 8, 2021, from https://www.lisa.org/consumer-advisors/why-sell/.

[6] Life Settlement Regulations by State (n.d.). Harbor Life Settlements. Retrieved November 29, 2021, from https://www.harborlifesettlements.com/life-settlement-regulations-by-state/.

[7] Nicholson, B. (2021, November 4). State of the Life Settlement Market. Retrieved November 29, 2021, from https://www.youtube.com/watch?v=mpplkNuMzuc&t=789s

[8] Soergel, A. (2019, July 7). Poll: 1 in 4 don’t plan to retire despite realities of aging. AP NEWS. Retrieved October 22, 2021, from https://apnews.com/article/lifestyle-business-aging-ap-top-news-politics-e38 b971fb04942eab297ffc9fa7f8d01.

[9] Cost of long term care by state: Cost of care report. Genworth. (n.d.). Retrieved October 18, 2021, from https://www.genworth.com/aging-and-you/finances/cost-of-care.html.

[10] Life Settlement History. Harbor Life Settlements. (n.d.). Retrieved November 8, 2021, from https://www.harborlifesettlements.com/history-of-life-settlements/.

[11] Watson, S. (2020, June 9). The history of HIV treatment: Antiretroviral therapy and more. WebMD. Retrieved October 22, 2021, from https://www.webmd.com/hiv-aids/hiv-treatment-history.

[12] Texas Judge Approves $1 Billion Settlement In Life Partners Investor Litigation. Beasley Allen. (2016, July 13). Retrieved November 8, 2021, from https://www.beasleyallen.com/article/texas-judge-approves-1-billion-settlement-life-partners-investor-litigation/.

[13] Raymond, N. (2016, February 29) AIG, Coventry First settle lawsuit over ‘life settlements’. Reuters. Retrieved November 8, 2021, from https://www.reuters.com/article/aig-trial-coventryfirst/aig-coventry-first-settl e-lawsuit-over-life-settlements-idUSL2N1681N5.

[14] Knueven, L. (2024, February 27) Average American Debt in 2024: Household Debt Statistics. Business Insider. Retrieved March 21, 2024, from https://www.businessinsider.com/personal-finance/average-american-debt.

[15] Contributor, R. D. G. (2020, December 22). Is your life insurance policy worth more than its cash surrender value? Retirement Daily on TheStreet: Finance and Retirement Advice, Analysis, and More. Retrieved October 22, 2021, from https://www.thestreet.com/retirement-daily/your-money/is-your-life-insuran ce-policy-worth-more-than-its-cash-surrender-value.

[16] Konish, L. (2024, January 2) These key factors affect how much Social Security income retirees will receive in 2024. CNBC. Retrieved March 21, 2024, from https://money.com/average-medicare-out-of-pocket/.

[17] Josephson, A. (2023, December 11) The Average Salary by Age in the U.S.. Smart Asset. Retrieved March 21, 2024, from https://smartasset.com/retirement/the-average-salary-by-age.

[18] Hardy, A. (2023, April 26) The Average Medicare Recipient Pays Over $6,500 Out of Pocket for Health Care Annually. Money. Retrieved March 21, 2024, from https://www.kff.org/medicare/press-release/medicare-beneficiaries-spent-an -average-of-5460-out-of-pocket-for-health-care-in-2016-with-some-groups-sp ending-substantially-more/.

[19] Tretina, K. (2021, October 13). Social Security COLA: How cost-of-living adjustments work. Forbes. Retrieved October 22, 2021, from

https://www.forbes.com/advisor/retirement/cola-social-security/.

[20] US health care inflation rate. Ycharts. (n.d.). Retrieved October 22, 2021, from https://ycharts.com/indicators/us_health_care_inflation_rate.

[21] Social Security and Medicare Boards of Trustees. (n.d.). A summary of the 2023 annual reports. Social Security Administration. Retrieved March 21, 2024, from https://www.ssa.gov/oact/trsum/.

[22] Budgetary and economic effects of repealing the Affordable Care Act. Congressional Budget Office. (2015, June 19). Retrieved October 23, 2021,

from https://www.cbo.gov/publication/50252.

[23] Snyder, L. (2016, December 21). Medicaid financing: How does it work and what are the implications? KFF. Retrieved October 22, 2021, from

https://www.kff.org/medicaid/issue-brief/medicaid-financing-how-does-it-work-and-what-are-the-implications/.

[24] Medicaid’s share of state budgets. MACPAC. (2020, March 3). Retrieved October 22, 2021, from

https://www.macpac.gov/subtopic/medicaids-share-of-state-budgets/.

[25] Status of state Medicaid expansion decisions: Interactive map. KFF. (2021, October 8). Retrieved October 22, 2021, from https://www.kff.org/medicaid/issue-brief/status-of-state-medicaid-expansiondecisions-interactive-map/.

[26] Assessing the out-of-pocket affordability of long-term services and supports research brief. ASPE. (2019, May 14). Retrieved October 22, 2021, from

https://aspe.hhs.gov/reports/assessing-out-pocket-affordability-long-term-services-supports-research-brief-0#table1.

[27] Collinson, C., Rowie, P. and Cho, H. (2015, May). Retirement throughout the ages: Expectations and preparations of American workers. Transamerica Center for Retirement Studies. Retrieved October 22, 2021, from https://transamericacenter.org/docs/default-source/retirement-survey-of-workers/tcrs2021_sr_four-generations-living-in-a-pandemic.pdf.

[28] U.S. foreclosure activity drops to 16-year low in 2020. ATTOM. (2021, January 14). Retrieved October 22, 2021, from https://www.attomdata.com/news/market-trends/foreclosures/attom-data-solutions-2020-year-end-u-s-foreclosure-market-report/.

[29] Coben, M. (2020, December 22). Is your life insurance policy worth more than its cash surrender value? Retirement Daily on TheStreet: Finance and Retirement Advice, Analysis, and More. Retrieved October 22, 2021, from https://www.thestreet.com/retirement-daily/your-money/is-your-life-insurance-policy-worth-more-than-its-cash-surrender-value.

[30] Weiss, C. (2014, May 05). California couple sues Lincoln National. ThinkAdvisor. Retrieved November 08, 2021, from

https://www.thinkadvisor.com/2014/05/05/california-couple-sues-lincoln-national/.

[31] U.S. Securities and Exchange Commission. (2010, July 22). Life settlements task force. Retrieved October 22, 2021, from https://www.sec.gov/files/lifesettlements-report.pdf.

[32] Seniors beware: What you should know about life settlements. FINRA. (2009, July 30). Retrieved October 22, 2021, from

https://www.finra.org/investors/alerts/seniors-beware-what-you-should-know-about-life-settlements.

[33] Life Settlements Report. The Deal. (n.d.). Retrieved October 25, 2021, from https://www.thedeal.com/solutions/life-settlements-report/.

[34] Covid money tracker. COVID Money Tracker. (n.d.). Retrieved October 22, 2021, from https://www.covidmoneytracker.org/https://www.cnbc.com/2024/01/02/4-factors-affect-how-much-social-security-retirees-receive-in-2024.html.

Recent Posts

Life Insurance Cost By Age: Premium Comparison Guide

See the cost of term and whole life insurance policies by age and gender, plus other helpful information you should know.

Running Out of Money in Retirement: Causes and Prevention Strategies

For many American retirees, the scariest part of retirement isn’t boredom or even health problems, it’s the fear of running out of money. A new

How to Plan for Health Care Costs in Retirement and Protect Your Savings

Discover how to manage health care costs in retirement. Learn about average expenses, Medicare coverage, tips, and how to unlock cash from life insurance.

What Qualifies a Person for a Nursing Home? A Compassionate Guide for Families

Choosing a nursing home is one of the hardest decisions families face. Whether you’re trying to find care for an aging parent, a spouse, or

Average Life Insurance Payout: How Much You Can Expect to Receive

Life insurance offers important financial protection, but many people wonder how much their loved ones will actually receive. The average life insurance payout in the

The Emotional Impact of Life Settlements for Seniors

Discover how life settlements help seniors turn old policies into cash and why letting go of life insurance can be the smart move.

Harbor Life Settlements Will Help You Get The Most Money For Your Life Insurance Policy