In this era of constantly escalating living costs, few people are able to avoid debt or adequately save for retirement. Even a single medical emergency can derail years of saving. As a result, people are working longer to pay off debt or looking for ways to downsize their expenses so they can retire before they’re 70.

If you’re nearing retirement and wondering if there’s any way to stop working earlier — or if you’re currently retired and want to improve your financial security — it’s important to look closely at your finances, particularly your liquid assets. Your life insurance policy may be one of the largest liquid assets you have, because certain policies build cash value and can even be sold for a lump cash sum through a process known as a life settlement, making them highly liquid. With this in mind, a lot of people wonder if their life insurance policy is considered an asset, and if so, is it a liquid asset?

In this guide, we’ll explain everything you need to know about life insurance as assets and liquid assets.

What is an asset?

An asset is anything you own that has value and can converted into cash. Assets include things you own like a car, home, jewelry, and money stored in your bank accounts and investments. These things can all be converted into money if needed, which is where their value comes from. They may be discussed when figuring out your net worth, which involves comparing your assets against liabilities, which is anything you owe to others.

Is life insurance an asset?

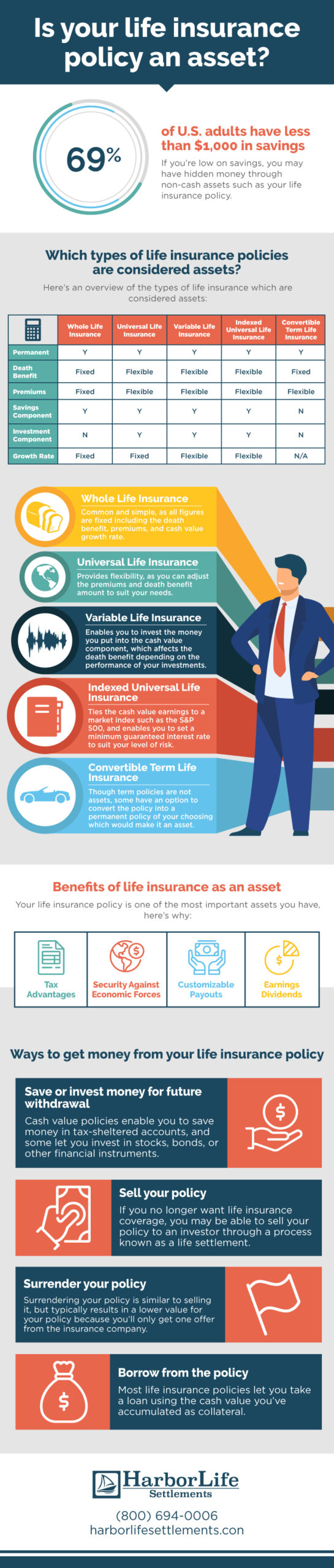

The death benefit of a life insurance policy is not considered an asset, so only policies with cash value are considered assets. Policies that have cash value and would be considered assets include whole life, universal, variable, and indexed universal. Term life insurance policies do not build cash value, but some can be converted into permanent policies that would accumulate cash value and be considered assets.

What is a liquid asset?

Liquidity refers to the ability of an asset to easily be converted into cash. Thus, liquid assets are assets that can quickly be converted into cash without a significant loss in value.

Liquid assets tend to be intangible, meaning they usually aren’t physical assets you can touch or hold in your hands like a home, car, or jewelry. Both businesses and individuals can have liquid assets, although businesses commonly referred to them as “current assets” on their balance sheet.

A share of Apple stock is an example of a very liquid asset; it’s highly demanded by investors and you can sell it quickly via the stock exchange. A share of a penny stock would be less liquid, however, because it might take some time to find an investor who wants to buy it.

Tangible assets like jewelry, cars, and real estate aren’t considered liquid assets because converting them into cash is a complex process, in which you may lose value. To “convert” a home into cash, for example, you have to advertise it, find a buyer, and then negotiate a price. As well, the price a buyer offers could be wildly different from what you had expected. Tangible items of value are sometimes called fixed assets.

What is an example of a liquid asset?

Common examples of liquid assets include:

- Money in a checking or savings account

- Stocks

- Securities

- Bonds

- Mutual funds

- Money market funds

Why are liquid assets important?

Liquid assets are important components of your financial strength. If you lose your job or get into a car accident, for example, you need cash on hand to cover your living expenses or fund your insurance deductible. You won’t have the time to sell your house or the jewelry you inherited from your grandma to pay those bills.

While fixed assets contribute to your net worth, liquid assets pay your bills in the short-term. That’s why mortgage lenders do a liquidity analysis when you apply for a home loan. The lender wants to see that you’ll be able to make your mortgage payments even through a financial hardship.

What does liquidity refer to in a life insurance policy?

With respect to life insurance, liquidity refers to how easily you can access cash from the policy. The concept applies mostly to permanent life insurance, because it accumulates cash value over time. Term life insurance doesn’t have that cash-value component.

Different types of permanent life insurance have varying degrees of liquidity. That relative liquidity hinges on how the funds in the cash account are invested. A whole life policy, for example, may hold your cash value in actual cash, where it grows at some established interest rate. You as the policyholder would have the right to withdraw some of those funds periodically. In that scenario, your life insurance is fairly liquid.

But what if you own variable life insurance, which invests your accumulated cash in funds tied to the financial markets? In that case, you’d have to sell those funds before taking a loan or withdrawal. Doing so exposes you to realized losses if those positions have dipped in value. That’s a less liquid structure than the whole life policy described above.

Additionally, some life insurance policies can be sold through a life or viatical settlement which adds to their liquidity because it provides another option to receive cash value. In fact, you may be able to receive a lump cash sum worth up to 60% of the death benefit amount by selling your policy which can significantly increase your liquidity. To find out how much your policy could be worth, you can use our life settlement calculator or contact us for a free estimate.

Which types of life insurance policies are considered assets?

Some life insurance is considered an asset, and a liquid asset at that. As explained below, there are two primary categories of life insurance, permanent and term. Generally, permanent life coverage is an asset, while term life coverage is not.

Permanent Life Insurance

Permanent life insurance is designed to cover you with a death benefit for the rest of your life, as long as you stay current on your premiums. Generally, those premiums remain the same for the life of the policy. Whole life, universal life, variable life, variable universal life, and indexed universal life are all types of permanent life insurance.

Permanent life policies have a savings component called cash value. A portion of each premium payment is funneled into the policy’s savings account and the money either earns interest or is invested in financial market funds. Either way, the earnings are tax-deferred.

Because the premiums pay for the life insurance as well as the cash value deposits, permanent life is more expensive than term life insurance. Those who own permanent life accept that higher premium in return for the added liquidity the cash value provides. Depending on the policy type, you can withdraw or borrow against your cash value balance. Note that cash withdrawals and loans do reduce the policy’s death benefit until those funds are repaid.

That liquidity makes permanent life insurance a fairly versatile asset — which is appropriate, given that your financial situation is likely to evolve substantially over time. You might purchase permanent life when you are young to ensure your family will be taken care of if something happens to you, for example. But as you get older, you might decide to use your accumulated cash value as a source of retirement income instead. Alternatively, you may even consider selling your permanent life insurance policy for a lump sum through a process known as a life settlement.

Term Life Insurance

Unlike permanent life insurance, term life coverage does have an expiration date. The policy might be structured to remain in force for one to 30 years, for example. After that time period ends, you can renew the coverage, but the premiums will be higher.

Term life policies only provide a death benefit and do not accumulate cash value. For that reason, this type of coverage is not considered an asset. The exception would be a term policy that can be converted to a permanent life policy. That is what’s called a convertible term policy and it is an asset. Once a term policy has been converted into a permanent policy, you receive all the benefits of a permanent policy that can help improve your liquidity. These benefits include utilizing the cash value component to earn interest, borrowing against the value of your policy, or selling it through a life settlement for a lump cash sum worth up to 60% of the death benefit amount.

Advantages and disadvantages of life insurance as an asset

Permanent life insurance is a versatile asset that can play several roles in your financial plan. When you’re younger, the death benefit can ensure funding to your family if something happens to you. As you age and your cash value grows, your life insurance can supplement your retirement income or provide liquidity in case of an emergency.

The advantages of owning life insurance include:

- Tax perks: The tax advantages of life insurance can be substantial, particularly if you have a high income. Notably, earnings within your cash-value account are tax-deferred. The loans you take against your cash value are tax-free (as long as you keep your policy in force while those funds are outstanding). And finally, the death benefit paid to your beneficiaries is also tax-free.

- Diversification outside the financial markets: On most life insurance policies, the death benefit is a fixed amount. If you die while that policy is in force, the insurer is contractually obligated to pay that amount to your beneficiary. It’s a guaranteed inheritance that will not rise and fall with stock market or economic cycles.

- Customizable payouts: You can usually specify how you or your beneficiaries will receive value from your policy. For example, you could structure the death benefit to be paid to your beneficiary in a lump sum or as a lifetime annuity.

- Dividend earnings: Many life insurance policies pay dividends on the earnings. Those are direct cash payments you can use to pay your premiums. You could also reinvest or spend those funds as needed.

The primary disadvantage of life insurance is the time it takes to build cash value. You aren’t likely to see momentum in your policy’s savings account until you’ve been paying premiums for 10 years or more. For that reason, it’s best to view your life insurance as a long-term asset.

Why life insurance is one of the first assets you should consider liquidating

Life insurance is an overlooked source of liquidity, but it may be your best option when you need cash fast.

Think of the scenarios in life that could put in you a cash crunch. What would you do if you wreck your car and owe more on your loan than it’s worth? You might also lose your job. You or your spouse might be in need of pricey medical treatments. Or you may need to create some breathing room in your budget by refinancing high-rate debt.

In any of those situations, it often makes sense to use the value in your life insurance first — before pulling money from, say, your 401(k) or selling your tangible assets. 401(k) withdrawals are taxable as income. And if you are younger than age 59 and a half, you may incur a 10% penalty on top of that tax liability. You could alternatively borrow from your 401(k), but then you usually can’t keep contributing until you’ve repaid the loan. That could be disastrous to your retirement plan.

Selling your car or home might be an option, but both transactions will take time and could be counterproductive. You might need the car to get to work, for example, and you definitely need a place to live.

A life insurance withdrawal or loan usually has no tax consequences, or you could look at selling your policy for a lump cash sum.

The importance of knowing the value of your assets, including your life insurance

The best way to ensure your liquidity in the face of an emergency is to save money to a cash account. The conventional advice is to target a cash savings balance that’s enough to cover three to six months of your living expenses.

While you are working towards that goal, it’s smart to inventory all of your assets and their value. You might even prioritize which you’d liquidate if you needed some quick cash.

It shouldn’t be too difficult to estimate value for most of your assets. For your life insurance, you’ll want to consider its accumulated cash value. It might also be interesting to know if your policy qualifies for a life settlement and, if so, what it’s worth. A life settlement involves selling your life insurance to a third-party investor for a lump sum of cash. Depending on the policy type, value, and your age, you may be able to sell your life insurance policy for up to 60% of the death benefit value.

Which types of life insurance policies can be sold?

Not all types of life insurance policies can be sold. Typically, you need to have whole, variable, universal, or convertible term coverage to be eligible to sell your policy in a life settlement. If the insured policyholder is terminally ill, standard term policies may also be eligible for a similar option known as a viatical settlement.

If you’re curious about your eligibility to sell and the potential value of your policy, Harbor Life Settlement can provide you with a FREE, no-obligation policy estimate. You may be eligible for up to 60% of the death benefit value for your policy in cash now. Our team will walk you step-by-step through the process and you are free to walk away at any time.

If you do decide to sell, you’ll receive a lump cash sum that can be used however you’d like. Life settlements are a popular choice for seniors, as the extra money can be used to fund retirement and make the most of your golden years. Few people realize their life insurance policy is an asset, so make sure you’re aware of its value.

Check out and share our infographic below for a visual reference, or contact Harbor Life Settlements today and find out how much your life insurance policy is worth!