Your parents clothed you, bandaged your skinned knees, and fed you dinner for years. And now, it may be time to return the favor, figuratively anyway. Did you know that some states make it your legal responsibility to support your parents financially? It’s true, and without some proactive planning to avoid filial responsibility, you may be at risk of footing the bill for your parents’ high-dollar medical debt.

In this article, we’ll explain what filial responsibility is, which states have filial laws, and other helpful tips to help you prepare or avoid a legal obligation to support your parents.

What is Filial Responsibility?

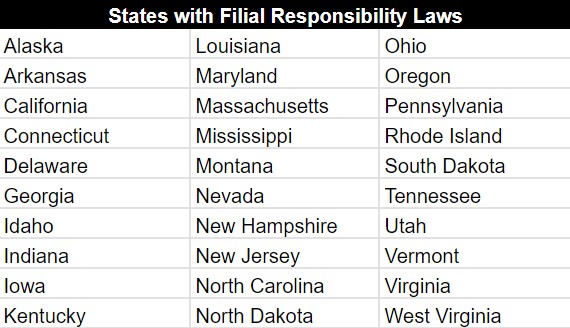

Filial responsibility refers to an adult child’s legal duty to support his or her parents. Thirty U.S. states currently have filial responsibility laws that obligate adult children to support parents if they can’t do it themselves. Filial laws require children to provide for parents’ basic needs such as food, housing, and medical care. The extent of filial responsibility varies by state, along with conditions that make it enforceable including the parent’s age and the adult child’s financial situation.

The medical care requirements of filial responsibility can be controversial. Funding copayments for your parents’ doctor visits is one thing, but absorbing a $100,000 bill for a nursing home stay is an entirely different level of support. Unfortunately, filial responsibility laws may not differentiate much between the two. If you live in a filial state and your parents start accumulating healthcare bills they cannot pay, the healthcare provider may be within its rights to sue you, and win.

Filial laws haven’t been uniformly enforced in the past, but experts predict a rise in enforcement going forward. Healthcare costs have gone up by an average 3.2% per year over the last 20 years, and the senior population is growing. Filial responsibility court claims are one way healthcare providers can recoup their costs when five- and six-figure medical bills go unpaid.

States With Filial Responsibility Laws

In 2024, there are 30 U.S. states with filial responsibility laws. These states are shown in the table below.

Filial responsibility laws can be very different from state to state. Georgia’s statute, for example, simply states that a child who’s able must support an impoverished parent. The Arkansas law requires an adult child to provide specifically for a parent’s mental health needs, but only when that child has the means to pay and the services are not covered by insurance. In Virginia, you and your siblings are financially responsible for medical bills including long-term care — but you are no longer responsible for that long-term care bill after your parent has been institutionalized for 60 months or more. Connecticut has filial responsibility laws that are only applicable to parents who are younger than 65 years old.

When are Filial Responsibility Laws Enforced?

Although filial laws in each state may differ, there are some commonalities when it comes to enforcement. You’re most likely to be deemed legally liable for a parent’s medical bills when:

- Your parent does not qualify for Medicaid

- Your parent is impoverished.

- Your parent has medical bills and cannot pay for them.

- You do have the ability to pay, or your parents fraudulently transferred assets to you.

If you live in a state with filial responsibility laws and these conditions apply, you may be legally obligated to support them. If a healthcare provider were to sue a parent for an unpaid medical bill, the court may declare that filial responsibility falls on the child.

4 Implications of Filial Laws

If you have elderly parents and you live in a filial state, filial laws should be a consideration in all major financial decisions, both for you and your folks. Overlooking these laws and your responsibility under them can lead to some fairly tricky situations, four of which are listed below.

1. You can be sued for your parents’ long-term care bills

Your mom’s family doctor isn’t going to sue you to recover a $25 copay. But when the debt figure is high, say $50,000 or more, the healthcare provider will be more motivated to take you to court. That’s why filial responsibility cases tend to involve long-term care bills. Even a short stay in a custodial care facility can be very expensive, and patients without Medicaid or long-term care insurance must pay these expenses out of pocket.

The best-known example of a filial law case is Health Care & Retirement Corporation of America v. Pittas of 2012. At issue was a $93,000 nursing home bill that an elderly patient did not pay. Upon her release from the home, the woman left the country. The nursing home then sued her son who was still in the U.S. The courts ruled that the son was financially able and therefore responsible for paying the bill.

A year after the Pittas case, a North Dakota Supreme Court found Elden Linderkamp liable for his parents’ unpaid medical debt — a balance of $104,000 owed to a nursing home. In this case, the parents had previously sold property to Elden and his wife for less than market value; the nursing home claimed that the transaction was intended to keep the property out of creditors’ hands. The court found Linderkamp and his wife liable for the debt.

2. You may face civil or criminal penalties

If a court of law declares you responsible for a parent’s medical bills, you are subject to the usual debt remedies, including wage garnishment, bank account seizure, and liens. You may also face jailtime for neglecting filial responsibility. According to North Carolina law, for example, the refusal to support your parents is a Class 2 misdemeanor. That can earn you a 60- or 120-day jail sentence.

3. Financial transactions between you and your parents could be scrutinized

The court may investigate your recent financial transactions to check for any suspicious or fraudulent activity that could indicate you’re trying to get out of your filial responsibility to a parent. Property transfers are likely to be scrutinized, as those transactions might be deemed “fraudulent conveyance,” which is a property transfer that’s intended to defraud creditors.

For example, if you own an extra home that contributes to your net worth, transferring it to a friend for free may reduce your net worth to a level that would make you appear less capable of financially supporting a parent. However, going through with the transfer to avoid filial responsibility is a form of fraud that’s illegal. You might also risk violating Medicaid asset transfer rules, which would make your parents ineligible for Medicaid. Expect any transfers in recent history to be scrutinized by Medicaid, by any unpaid healthcare provider and, later, by the court if you are sued.

4. You may have to sue siblings or your parent’s spouse to recover funds

The law isn’t clear-cut with respect to how siblings and spouses should share responsibility for the family member’s medical debt. In the Pittas case, the Pennsylvania Superior Court ruled that the nursing home could pursue a judgment against Pittas alone, even if other relatives in the state were also financially responsible under the filial statutes.

Even if you have siblings who should share in the filial responsibility, the healthcare provider can come after you alone. If a judgment is rendered against you, it would be up to you to sue your siblings and recover their share of the debt.

How To Avoid Filial Responsibility

The unfortunate conclusion is this: If you live in a filial state, you can be forced to pay parents’ medical bills — and that applies even if your parents are estranged and you didn’t play a role in their medical decision-making. The takeaway? Get involved in your parents’ financial planning and healthcare decisions now. If the medical bills are ultimately your responsibility, you should make sure they’re handled properly — well before you end up in a lawsuit.

Here are four action steps you can take today to avoid filial responsibility and a potential medical debt battle.

1. Start the conversation with your parents

As awkward as it might be, you’ll have to ask your parents about their finances and, in particular, any plans they’ve made for long-term care. If your parents are wealthy, you’re not really at risk of being sued for their bills; unpaid healthcare providers would go after your parents’ assets before going after yours. The danger zone for you is when your parents are too wealthy to qualify for Medicaid, but not wealthy enough to cover hefty medical or long-term care bills.

In you’re in that danger zone, find out what plans your parents have made for long-term care. Common strategies include:

- Long-term care insurance

- Life insurance with long-term care benefits

- Permanent life insurance that can be cashed out or sold through a life settlement

- Home equity that can be cashed out in a reverse mortgage or home sale to raise funds

2. Collaborate with other family members

If your parents haven’t made plans for long-term care, that’s your cue to round up your siblings and have a planning conversation. Hopefully, your family members will share your desire to get proactive about the situation. Ideally, the group would collaborate on a plan that protects everyone’s assets and ensures your parents have access to the care they need.

3. Consult with an elder care attorney

Whether your siblings want to participate or not, you should consult with an elder care attorney. Elder care attorneys specialize in issues involving long-term care and Medicaid qualification. The right lawyer can explain your responsibilities under the filial laws in your state and devise a workable strategy for long-term care. That strategy likely involves some estate planning moves for your folks and possibly you too.

4. Help them qualify for Medicaid

If your parents can legitimately qualify for Medicaid, that dramatically lowers your risk of absorbing their medical debt. There are legal ways to lower your parents’ income and assets enough for them to be eligible for Medicaid, should they need long-term care. These strategies are called Medicaid spend-down. You would need the expertise of an elder care attorney or financial advisor to devise and implement a spend-down strategy.

Know Your Filial Responsibilities and Plan Ahead

If only your parents’ medical issues were treatable with a shot of Bactine and a Band-aid. Unfortunately, medical and custodial care for seniors is far more complicated than a skinned knee. Talk to your folks today about the state of their finances and the plans they’ve made for long-term care. The earlier you have this conversation, the more time you have to plan a strategy that protects you and provides them with access to the care they need.