Retirement should be a time of peace, not a time to worry over rising health care bills. But between Medicare premiums, long-term care, and prescription drugs, health care costs in retirement can quickly become one of the largest items in your budget. Without proper planning, these expenses can erode your savings faster than you might expect.

In this guide, we’ll walk you through:

- The average health care costs in retirement you should anticipate.

How Medicare works and where it falls short.

Options for health insurance before Medicare eligibility.

Smart strategies on how to plan for health care costs in retirement.

Ways to unlock hidden cash from life insurance policies you may no longer need.

The Real Cost of Health Care in Retirement

What do health care costs in retirement really add up to? According to Bank Of America: “A couple would need $351,000 to have a 90% chance of having enough savings to cover health care cost in retirement”.

Merril Lynch states that “a healthy 65-year-old couple who retired in 2023 will likely use nearly 70% of their lifetime Social Security benefits to cover their medical costs in retirement”.

A 2024 estimate from RBC Wealth Management puts the lifetime health care cost for a 65-year-old couple at $683,306, and that doesn’t include long-term care.

Why is there such a wide range of estimates? Your total costs will depend on your health, where you live, your insurance coverage, and how long you live.

Average Health Care Costs in Retirement: What You Should Expect

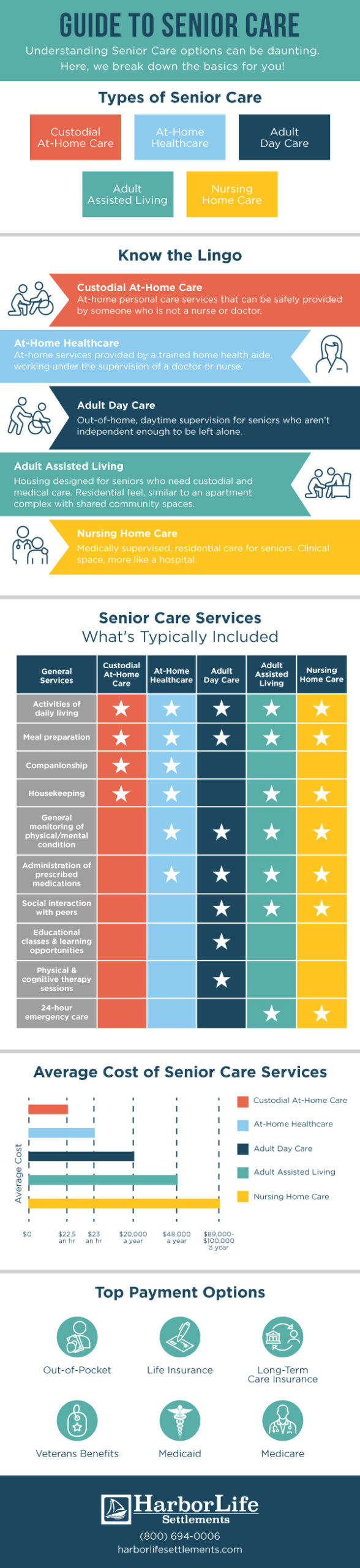

Senior care expenses vary widely depending on the type and level of care needed:

Adult day care: One of the most affordable options, costing about $1,625 monthly.

Full-time in-home health aide: More than double adult day care costs, averaging $4,400 per month.

Nursing home care: Ranges from $8,200 to $9,500 monthly, with private rooms at the higher end.

These are today’s costs, but they’re expected to rise sharply. Assuming a moderate 3% annual inflation rate, in 10 years:

Full-time in-home care could cost nearly $5,900 per month.

A private nursing home room could exceed $11,000 per month by 2029.

What Medicare Covers and What It Doesn’t

Medicare is the federal program providing health coverage starting at age 65, but it doesn’t pay for everything:

Part A (Hospital Insurance): Covers hospital stays, skilled nursing, and hospice care. Most people pay no premium.

Part B (Medical Insurance): Covers doctor visits and outpatient services. Requires a monthly premium.

Part D (Prescription Drugs): Optional coverage for medications. Premiums vary.

Medigap (Supplemental Insurance): Private plans that help cover deductibles and co-pays not paid by Medicare.

Medicare Advantage (Part C): Bundles Parts A, B, and often D into one plan via private insurers.

What Medicare doesn’t cover:

Long-term custodial care, most dental, vision, and hearing services, eyeglasses, hearing aids, and health care outside the U.S.

Failing to plan for these gaps can lead to large out-of-pocket expenses.

Health Insurance Costs Before Medicare Eligibility

If you retire before 65, you’ll need to secure health insurance until Medicare starts. Options include:

COBRA continuation of your employer plan (often expensive).

Coverage through a spouse’s employer plan.

ACA marketplace plans (costs vary, may have subsidies).

Private insurance.

The average monthly cost for individual Affordable Care Act (based on a report form) coverage for early retirees (ages 62–64) is about $1,100 per person, totaling roughly $2,100 for a couple not including deductibles and co-pays. These costs can quickly drain savings if not planned for.

How to Plan for Health Care Costs in Retirement: Practical Steps

To manage these expenses:

Maximize tax-advantaged accounts: Contribute to 401(k)s, IRAs, and especially Health Savings Accounts (HSAs), which offer triple tax benefits: deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. HSAs can cover Medicare premiums, prescription drugs, dental, vision care, and some long-term care costs.

Consider delaying Social Security: Waiting increases your monthly benefit, giving you more income to cover health costs later.

Evaluate Medicare plans annually: Choose coverage that fits your health needs and budget; consider Medigap or Medicare Advantage.

Protect against long-term care costs: Consider long-term care insurance or hybrid policies with long-term care riders.

Maintain a healthy lifestyle: Prevent chronic diseases to reduce medical costs.

Ways to Pay for Senior Care

Most families don’t have an extra $5,000–$10,000 monthly to cover senior care, so creative planning is often necessary. Consider these six options, alone or combined:

Out-of-pocket: Using savings, investments, or home equity is common but risks exhausting assets. After assets are depleted, seniors often qualify for Medicaid, which covers many expensive long-term care services.

Life insurance: Seniors can access cash through loans, policy surrender, life settlements, or viatical settlements (for terminally or chronically ill individuals). Some policies offer accelerated death benefits, allowing terminally ill insureds to access funds early. Life settlements and accelerated death benefits generally provide the most cash.

Long-term care insurance: Covers costs of in-home or facility care once a medical professional certifies the need for assistance with activities of daily living (ADLs) like eating or grooming. Benefits are subject to policy limits and premiums can be expensive, especially if purchased later in life.

Veterans benefits: The VA’s Aid and Assistance program offers up to $2,170 monthly for eligible veterans needing nursing home, assisted living, or in-home care. Eligibility requires a basic VA pension and ADL assistance.

Medicaid: For low-income seniors meeting strict financial criteria, Medicaid covers many long-term care services, including some adult day care.

Medicare: Pays for short-term skilled nursing or intermittent home health services but does not cover custodial care, assisted living, long-term nursing home stays, or dementia care.

Disclaimer: Median monthly costs for senior care vary, with home care averaging around $5,700 and nursing home care ranging from $7,900 to over $9,000, according to A Place for Mom and Genworth Financial.

Lifestyle Choices Matter: Manage Your Health to Reduce Costs

While some health care expenses are unavoidable, maintaining a healthy lifestyle can reduce the need for costly medical care. Simple habits can make a big difference:

Eat a balanced diet

Stay physically active

Get regular preventive checkups

Avoid tobacco and limit alcohol

Manage stress and get enough sleep

Preventing chronic conditions like diabetes and heart disease can protect both your health and your retirement savings.

Unlocking Cash from Your Life Insurance Policy

If you already have a life insurance policy you no longer need, a life settlement can provide a lump sum cash payout to help cover medical and long-term care costs. In a life settlement, you sell your policy to a licensed buyer who takes over premium payments and collects the death benefit later.

You may qualify if:

You’re age 65 or older

Your policy has a death benefit of $100,000 or more

You’ve had a health change or no longer need the policy

Start with a free, no-obligation estimate to see what your policy could be worth.

Take Control of Your Health Care Costs in Retirement

Rising health care costs in retirement are a major challenge but with the right planning, you can protect your finances and enjoy your golden years. Understand your coverage, budget carefully, maximize savings accounts like HSAs, and explore insurance options early. And if needed, unlock cash from assets like your life insurance policy.

Retirement should be your time to enjoy life. Don’t let health care expenses take it away.