More than two-thirds (70%) of Americans carry life insurance. Many of these policyholders are motivated by what life insurance policies do best: securing financial protections for surviving family members. But the life insurance industry has gotten increasingly complex over the last several decades. And while that complexity can benefit policyholders, it has the potential to alienate consumers — leaving them uncertain, first, about the type of life insurance they need, and, later, what they can do with their life insurance once they have it.

To better understand people’s views towards and knowledge about life insurance, Harbor Life Settlements conducted a nationwide survey of 1,702 U.S. adults across four generations. The survey explored these key topics:

- What drives the decision to buy life insurance? Do life insurance needs evolve over time and, if so, how?

- What factors prevent Americans from buying life insurance?

- To what extent are U.S. adults aware of the option to sell life insurance via a life or viatical settlement?

- How do Americans rate their own financial preparedness for retirement?

The insights from the Harbor Life 2020 Life Settlement and Retirement Survey shared below can help consumers and financial advisors recognize and address knowledge gaps about life insurance. Filling those gaps contributes to better decision-making and, ultimately, a more effective financial and retirement plan.

Why People Buy Life Insurance: Death Benefit is Primary

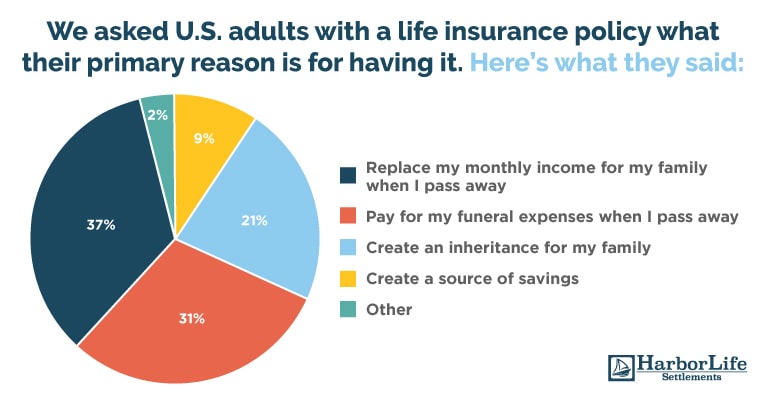

By and large, people purchase life insurance primarily for the death benefit. When asked to choose the main reason they have life insurance, policyholders overwhelmingly chose reasons related to the policy’s death benefit:

- To replace my monthly income for my family when I pass away (37%).

- To pay for my funeral expenses when I pass away (31%).

- To create an inheritance for my family (21%).

An insured’s age and family situation does influence whether the death benefit is intended to cover lost income, funeral expenses, or an inheritance, however. And this makes sense: Singles, nonparents, and seniors1 are less likely to be family breadwinners. Without relatives who’re dependent on their income, they’re primarily concerned with future burial costs. Working spouses and parents2, though, are more worried about the financial needs of surviving family members.

Some interesting differences showed up in the motivations of working adults vs. retirees. Working adults are 64% more likely to lean on life insurance to create an inheritance than retirees. They’re also 150% more likely than retirees to have insurance for its savings features. Savings in a permanent life policy is related to the accumulation of cash value, which allows the policyholder to access those funds while living. Generally, withdrawing or borrowing against the funds reduces the death benefit. Only 9% of policyholders in total have life insurance to create a source of savings.

Term life is the most common

Given that a majority of policyholders maintain life insurance for the death benefit, it follows that the most popular policy type is term life. Term life, held by 35% of policyholders, has more affordable premiums, because it offers a death benefit only and no cash value or savings component.

The next most popular choice of policy type is whole life insurance, held by 31% of policyholders. Whole life does have a savings component, along with higher premiums. The 31% ownership rate of whole life seems high, given that only 9% of policyholders identified savings as their primary motivation for having life insurance. The implication is that policyholders primarily want the death benefit, but many also appreciate a policy’s savings features as a secondary source of value. Notably, parents are 67% more likely to have a whole life policy than nonparents.

Other types of cash-value life insurance are less prevalent. Only 12% of insureds are covered by a universal life policy, for example. The data indicate that universal life is more popular with married individuals. Specifically, 14% of married policyholders own a universal life policy vs. 7% of unmarried policyholders. Universal life insurance has a death benefit, cash savings component, and a flexible premium. Policyholders can pay a higher premium to increase their savings or the minimum premium needed to keep their death benefit intact.

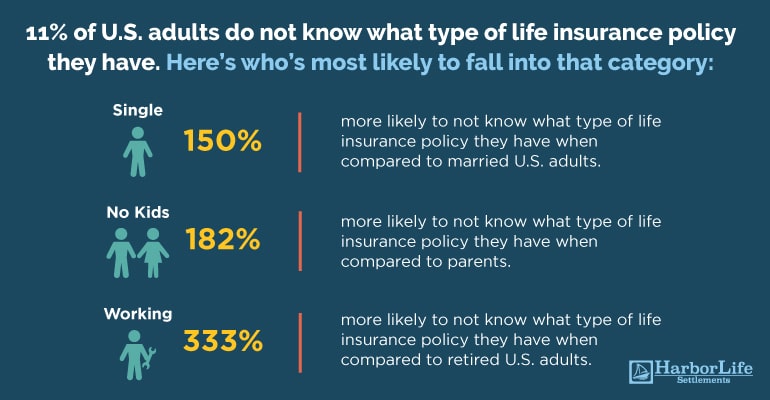

More than 10% of policyholders don’t know what type of life insurance they have

Interestingly, 11% of policyholders don’t actually know what type of life insurance they have. Individuals in this group are more likely to be unmarried, still working, or without children or dependents. For example:

- Single U.S. adults are 150% more likely than married adults to not know what type of life insurance they have (20% vs. 8%).

- Non-parents are 182% more likely than parents to not know what type of life insurance policy they have (17% vs. 6%).

- Working adults are 333% more likely than retired adults to not know what type of life insurance policy they have (13% vs. 3%).

Millennials and Gen Z potentially value life insurance more than older adults

Most adults (77%) think it’s important to have life insurance after the age of 65, but this group is skewed towards younger generations. Only 5% of Millennials3 and Generation Z4 respondents combined (aged 18 to 40) believe that life insurance after the age of 65 is not important. This compares to 12% of respondents aged 41 and older.

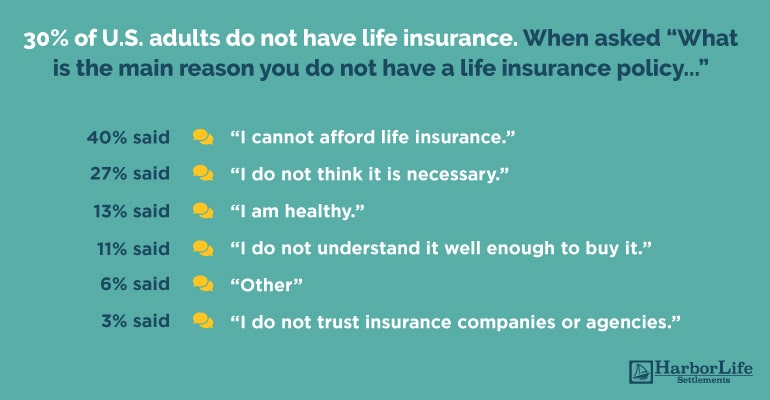

Why People Don’t Have Life Insurance: Affordability and Need

Among the 30% of U.S. adults who don’t have life insurance, affordability and necessity were key themes. When asked, “What is the main reason you do not have a life insurance policy,” respondents answered as follows:

- 40%: I cannot afford life insurance.

- 27%: I do not think it is necessary.

- 13%: I am healthy.

- 11%: I do not understand it well enough to buy it.

- 6%: Other

- 3%: I do not trust insurance companies or agencies.

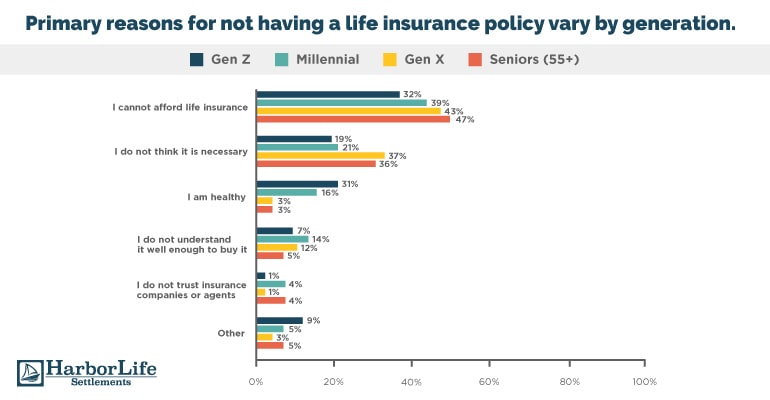

Older adults are more likely to view life insurance as unaffordable

Cost is the most common obstacle to purchasing life insurance across the board, but attitudes about cost fluctuate based on age. Older adults are more likely to cite cost as the reason for not having life insurance than younger ones. Specifically, 45% of Seniors and Generation Xers5 say they can’t afford life insurance, vs. 37% of their younger counterparts. Looking just at retirees, 36% say they can’t afford life insurance.

It’s not surprising that older adults have an issue with the cost of life coverage — premiums are higher for older applicants than younger ones. Among retirees who do have life insurance, for example, 17% are paying $501 or more monthly for their coverage.

Younger adults say their good health justifies not having life insurance

Younger adults are more likely to resist buying life insurance on the basis of their good health, rather than affordability. While only 13% of adults cited good health as the main reason for not having life insurance, most of those individuals are 40 or younger. Specifically, 20% of Millennials and Generation Zers said they didn’t have life insurance because of their good health, compared to only 3% of older adults.

There is a bit of a trap in that logic. A younger, healthier applicant qualifies for lower premiums, but may believe life insurance isn’t necessary. That individual can age, develop health problems, and then see a greater need for life insurance. At that point, premiums will be higher and, possibly, not affordable. That points to an opportunity to educate younger adults about the importance of securing life coverage earlier in life, to lock in a more affordable premium while they are healthy. Some types of life insurance, such as whole life, offer fixed premiums for the insured’s lifetime.

Seniors understand life insurance, but don’t think it’s necessary

Seniors largely feel confident in their knowledge of life insurance. Only 5% of seniors said they didn’t understand life insurance well enough to buy it. The sticking point for many seniors (36%) in having life coverage was simply that they didn’t think it was necessary.

Younger adults are more likely to have no life insurance because they don’t understand it

Younger adults did express a lack of understanding about life insurance, however. For example:

- Twelve percent of working adults said they didn’t understand life insurance well enough to buy it, vs. 4% of retirees.

- Adults under the age of 55 are 140% more likely to not have life insurance because they don’t understand it vs. adults 55 and older.

- Millennials are 75% more likely than non-Millennials to not have life insurance due to a lack of understanding.

Many Policyholders Don’t Know the Full Potential of Their Coverage

While most U.S. adults feel comfortable with their understanding of life insurance, survey results show a lack of knowledge with respect to life settlements and viatical settlements. These settlements involve selling a life insurance policy for cash to a third-party buyer.

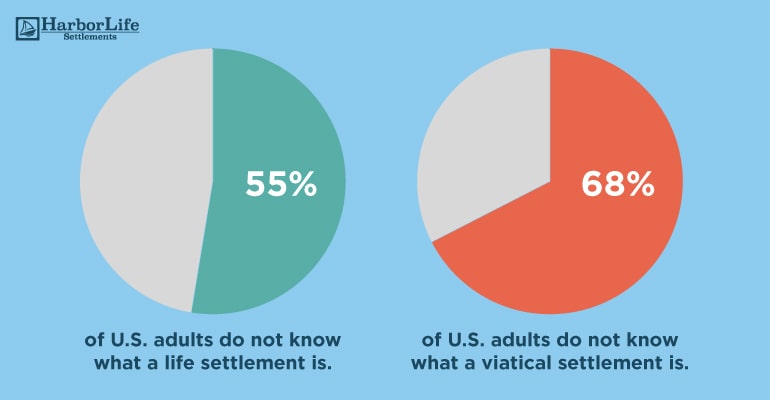

More than half (55%) of U.S. adults do not know what a life settlement is, and more than two-thirds (68%) do not know what a viatical settlement is. Looking specifically at those who have life insurance, the numbers are more startling:

- 43% of adults with a life insurance policy don’t know what a life settlement is.

- 57% of adults with a life insurance policy don’t know what a viatical settlement is.

In other words, a large percentage of people who’ve been paying policy premiums, maybe for many years, aren’t aware they can sell their policy. Life settlements and viatical settlements generally raise more money for the insured than surrendering the coverage or letting it lapse. Even so, nearly one-third (29%) of adults have surrendered or lapsed a life insurance policy — possibly leaving money on the table.

How life and viatical settlements work

Life settlements and viatical settlements are similar in that both involve transferring a life insurance policy to a third-party buyer, in return for a cash payment. The transaction is categorized as a life settlement when the policyholder is a senior who’s not been diagnosed with a chronic or terminal illness. Viatical settlements are reserved for insureds who are chronically or terminally ill and have a lifespan of less than 24 months. Generally, the sales value of a life insurance policy is greater than the policy’s cash value or surrender value.

Once the transaction is complete, the seller is no longer responsible for the insurance premiums and has no rights to the policy’s death benefit.

Funds generated from the transaction are not restricted in any way. Policy sellers can use the money to pad their savings, cover healthcare expenses, pay off debt, or take a trip around the world, as they see fit. Both life and viatical settlements can affect eligibility for needs-based assistance, and a portion of the proceeds may be taxable.

A relatively unknown option for cash-strapped seniors

The biggest knowledge gap about life and viatical settlements resides with seniors — sadly, the demographic that’s most likely to benefit from selling their insurance over the next decade. Sixty-three percent of seniors aged 55 and over don’t know what a life settlement is, relative to 53% of those aged 54 or younger. And, 75% of seniors aren’t familiar with viatical settlements, relative to 66% of adults younger than 55. This same senior group is also more likely to have let a policy lapse because they couldn’t afford the premiums.

Retirees are slightly more knowledgeable about life and viatical settlements than working adults. Sixty-seven percent of retirees know about life settlements, compared to only 39% of working adults. With respect to viatical settlements, 59% of retirees are familiar with them, relative to only 26% of working adults.

Despite the higher awareness among retirees about life and viatical settlements, many have surrendered their policies or let them expire. Two-thirds of retired adults admit to having let a policy lapse or expire, and 37% say they let a policy lapse or expire specifically because they couldn’t afford the premiums.

When premiums become a financial burden, a life settlement is often the better solution — because it eliminates the premium and produces higher cash proceeds for the seller.

1 in 5 Retired Seniors Are Worried About Finances

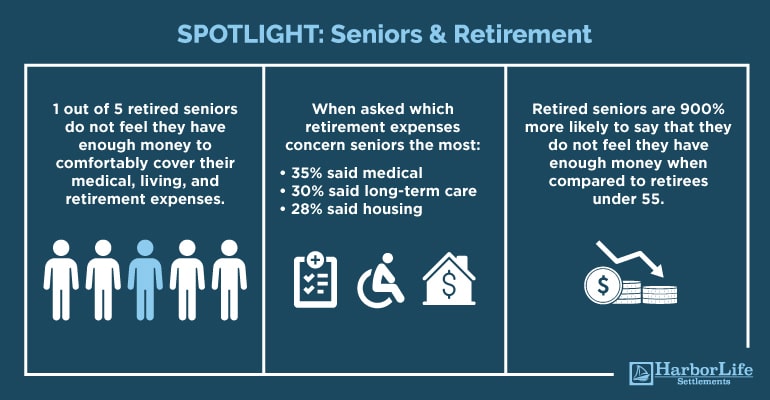

One in five retired seniors don’t feel they have enough money to cover their medical, living, and retirement expenses comfortably. As you might guess, older, single retirees are more likely to fall into this group than their younger, married counterparts. Retired seniors are 900% more likely to be concerned about having enough wealth to cover their expenses vs. retirees under the age of 55. In contrast, nearly all Generation X and Millennial retirees believe they have the funds needed to protect their lifestyle. As well, 28% of non-married retirees think they don’t have enough wealth to cover their expenses, compared to just 5% of married retirees. Married couples likely feel more secure in their finances because two individuals have greater earnings and savings power than one.

It is also understandable that younger retirees are more comfortable in their financial situation; these individuals presumably retired before the conventional age of 65 because they had the financial means to do so. They probably also have more ways to generate income, should their financial situation change — such as gig work or even returning to the workforce temporarily. Older retirees, however, are more likely to face factors that would keep them out of the workforce, including health problems or job discrimination. Understanding the market value of their life insurance could add financial flexibility for these retirees who can’t easily generate income in more conventional ways.

Medical, housing, and long-term care expenses are top concerns

Medical expenses, housing expenses, and long-term care expenses are top on retirees’ list of financial concerns. Thirty-four percent of retirees selected medical expenses as the expense that concerned them most. Another 27% chose housing expenses and 25% selected long-term care expenses.

Social Security, life insurance are popular funding sources for retirement.

When asked about funding sources for retirement, retirees selected these three options most frequently:

- Social Security (53%)

- Life insurance (46%)

- Pensions (39%)

The reliance on life insurance is an interesting data point, given that only 9% of policyholders said they’d bought the insurance to create a source of savings. Retirees are 24% more likely than non-retirees to rely on life insurance as a funding source. However, the lack of knowledge around life and viatical settlements shows that many policyholders aren’t fully aware of the value in their life insurance. Given that 78% of retirees have an active life insurance policy and nearly half of them plan to use that insurance to fund their lifestyle, there’s an opportunity for life and viatical settlements to ease some financial pressures for cash-strapped retirees.

The Role of Life Insurance

The Harbor Life 2020 Life Settlement and Retirement Survey reveals knowledge gaps that may be preventing policyholders from using their life insurance to its full potential. More than 10% of policyholders don’t know what type of life insurance they have, 43% don’t know they can sell their policy in a life settlement, and 57% don’t know what a viatical settlement is.

The policy’s death benefit may be the big selling point, but financial needs do evolve over time. A retiree who’s facing rising healthcare and living expenses, for example, may decide the death benefit is less important than remaining solvent. In that scenario, it’s important to understand if a policy’s benefits can be accessed while the insured is still living — via draws against cash value if available, a life settlement, or a viatical settlement.

Advisors have a role to play here. Through their guidance, clients can better understand how different types of life insurance work, whether there’s an insurance solution that suits their needs both today and tomorrow, and the ways a policy can be liquidated when the death benefit is no longer needed.

Survey Methodology

The data presented here is based on an August, 2020 survey conducted by Harbor Life Settlements. Respondents were comprised of 1,702 U.S. adults, aged 18 or older, a representative sample of U.S. adults, with a confidence level of 95% and a 2.5% margin of error.

Survey Post Key (numbers refer to exponents throughout post):

- Seniors are defined as respondents aged 55 and older.

- Parents are defined as respondents who have at least one child under the age of 18 living at home.

- Millennials are defined as respondents aged 26 to 40.

- Generation Z is defined as respondents aged 18 to 25.

- Generation X is defined as respondents aged 41 to 54.