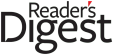

Most people buy life insurance to leave money for family members when they die, but there are also ways to get cash out of a policy while you’re alive. Some options include taking a loan, withdrawing cash value, using living benefits, or selling the policy.

There are pros and cons to each option, so it’s important to understand the differences so you can determine which is best for your situation.

In this post, we’ll discuss what it means to cash out a life insurance policy and the options for doing so.

Key Takeaways

- Cashing out a life insurance policy allows you to get money or benefits from the policy while you’re alive

- Permanent life insurance policies can be cashed out, but term policies must be converted to do so

- Options for cashing out a life insurance policy include taking a loan, withdrawing money, surrendering the policy, paying premiums with cash value, using living benefits, or selling the policy

What is life insurance cash value?

Cash value is a component of permanent life insurance policies including whole life, universal life, variable life, and indexed universal life insurance. When you pay premiums on these policies, one portion of the money goes to the insurance company to provide insurance coverage and the other portion goes to a savings component that builds cash value over time. Depending on the policy type, the cash value may be invested or can sit and grow tax-deferred interest.

What does it mean to cash out a life insurance policy?

Cashing out a life insurance policy refers to the options you have to access your policy’s cash value while you’re alive. This includes taking a loan, withdrawing the money, surrendering the policy, paying premiums with funds, using living benefits, or selling the policy.

Unused cash value for a life insurance policy typically goes back to the insurance company after your death, so it’s recommended to use the money while you’re alive to prevent it from going to waste.

Can you cash out a life insurance policy?

The only requirement for cashing out a life insurance policy is that it has to be a permanent policy such as whole life, uiversal life, variable life, or indexed universal life insurance. Term life insurance policies can’t be cashed out because they don’t have any cash value. However, some term policies can be converted into permanent policies that can be cashed out. Of course, you may need to wait a while for the cash value to accumulate after the conversion.

How to cash out life insurance while you’re alive

Since unused cash value typically goes back to the insurer after your death, it makes sense to use that money while you’re alive. Here are your options for cashing out your policy.

1. Take a loan on your policy

Most life insurance companies allow you to take a loan on your policy’s cash value. The borrowing limit is set by your insurer, but it’s typically no more than 90% of the policy’s cash value. Unlike traditional loans, there’s no credit check and repayment schedules are flexible. In fact, you can choose not to repay the loan at all and the money will be taken out of your death benefit after you die. However, the loan will accumulate interest and reducing your death benefit means less money for beneficiaries.

2. Withdraw money from your cash value

Withdrawals allow you to take money from the cash value of your policy without worrying about interest charges. This is likely the easiest and fastest way to cash out a life insurance policy. The money you take out is also tax free up to the amount of premiums you’ve paid. So if you’ve paid $20,000 in premiums, you can withdraw that amount without paying any income tax. However, you’ll have to pay tax on any earnings that exceed that amount from accumulated interest or investment gains.

3. Surrender your policy

Surrendering a policy effectively cancels your coverage and awards you all the cash value you’ve accumulated. When you surrender your policy, the death benefit will also be cancelled which means beneficiaries won’t get anything when you die. Additionally, you may have to pay a surrender fee and income tax on earnings if your payout exceeds the premiums you’ve paid.

4. Use your cash value to pay premiums

You can use your cash value to pay policy premiums rather than covering those costs out of pocket. This can be valuable later in life when you’re on a limited income, as the policy essentially pays for itself using the money you’ve put in over its lifespan.

5. Use your policy’s living benefits

Living benefits are riders on life insurance policies that allow you to get a portion of the death benefit early if you’re diagnosed with a terminal illness and have a life expectancy of one year or less. Living benefit riders may provide up to 50% of the death benefit in advance, which can be used to cover medical costs for your care. Some life insurance policies include living benefit riders as standard with no additional costs, while others offer them as an optional add-on for a fee.

6. Sell your policy

You can sell your life insurance policy to a third party through a transaction known as a life settlement. When you sell your policy, the buyer will pay you a lump sum that’s more than the cash surrender value, but less than the death benefit. When the transaction is complete, the buyer takes responsibility of premium payments and collects the death benefit upon your passing.

If you no longer want coverage, selling a policy will always be a better option than surrendering it because the value is higher. In fact, LISA’s 2023 Annual Market Data Collection Survey found that on average, selling a policy awarded a value that was 622% higher than the cash surrender value. Still, it’s important to weigh alternatives before proceeding.

Do you have to pay taxes when cashing out a life insurance policy?

You generally don’t need to pay taxes when cashing out a life insurance policy, with the following exceptions:

- Tax on Earnings: Cash value grows over time from interest or investment gains, and you’ll be taxed on any profit that exceeds the premiums you’ve paid into the policy.

- Tax on Unpaid Loans: If you take a loan on a policy and let it lapse, you’ll have to pay income tax on the amount you owe when coverage ends.

Pros and cons of cashing out life insurance

Here are some of the most noteworthy advantages and disadvantages of cashing out a life insurance policy:

Pros

- Access Cash Value: You can use the money from your policy while you’re alive, which otherwise will likely go back to the insurer upon your passing.

- Low Interest Rate Loan: The interest rate on a loan from your cash value is typically 6-8%, much lower than the 12.38% average rate for a personal loan from the bank. Additionally, you don’t need a credit check or collateral and the repayment schedule is flexible.

- Cover or Eliminate Premiums: You can use the cash value to completely cover your premiums, or eliminate them completely by surrendering or selling the policy.

- Generally Tax-Free Funds: The cash value you get is tax-free up to the amount of premiums you’ve paid. However, you will have to pay taxes on earnings or if you let a policy with a loan lapse.

Cons

- Less Future Earnings: Accessing cash value now reduces the long-term growth potential of the remaining balance.

- Potential for No Death Benefit: Selling or surrendering your policy means beneficiaries won’t get a death benefit, and other options could cause the policy to lapse if you find yourself in a position where you can’t pay premiums or tax on earnings.

What to consider when using life insurance while alive

Most people buy life insurance to create a financial safety net for loved ones upon their death, but there are ways to access the value of the policy while alive. Cashing out a policy early can provide financial support now, but it typically means a lower payout in the future. To decide if you should use your life insurance while alive, here are some important considerations.

Coverage Needs

Would you like to maintain life insurance coverage after cashing out, or are you fine with no longer having coverage? If you want to keep coverage, you can simply withdraw money from the cash value you’ve accumulated or take a loan on it from the insurance provider. You may also be able to cash out using living benefits to help pay for care services while maintaining coverage. If you no longer need coverage, you can surrender or sell the policy to get your cash value.

Financial Situation

Do you need a lot or a little money, and do you need it now or can you wait a few months? If you’re in a bind and need a little extra cash now, withdrawing money is likely your best option. However, if you need a larger sum or if you can afford to wait, you can look at other ways to cash out a policy such as a loan, surrender agreement, or selling the policy.

Beneficiary Needs

Will your beneficiaries have the financial means to support themselves with a reduced death benefit, or potentially no death benefit at all? Consider the needs of your loved ones to ensure they won’t be left in a difficult spot upon your death.

Hidden Fees and Conditions

Are there any fine print details that would reduce the amount you get from cashing out your policy? Insurance policies are often packed with confusing language, so it’s a good idea to read carefully and even let a financial advisor take a look to make sure you don’t get any surprise fees or clauses that reduce your payout at the last minute.

Should You Cash Out Your Life Insurance?

Cashing out a life insurance policy can be beneficial if you need money now, but it’s important to understand the long-term implications the transaction will have on your finances and beneficiaries. Carefully consider your options to figure out which, if any, is the best way to use your policy while you’re alive.

If you’re interested in selling your life insurance policy, contact us or use our life settlement calculator to find out how much it’s worth. The estimate is free, and doesn’t require an obligation to continue if you choose to walk away after getting the value.