There’s an old joke about insurance: What do hospital gowns and insurance policies have in common? You’re never covered as much as you think you are. If you cracked a smile just now, it’s only because that joke has more truth than humor. We’ve all questioned the value of insurance at some point, whether it’s car insurance, life insurance, or health insurance. But one of the biggest mysteries of the insurance industry is long-term care insurance.

When you start shopping for long-term care insurance, you’ll realize quickly that it’s pricey and complicated. And that can leave you wondering whether this form of coverage is worth it. Unfortunately, there’s no short answer to that question. Long-term care insurance can add value in certain situations, depending on the coverage, as well as your net worth, your age, and your health history.

To help you determine if long-term health insurance is worth the cost, we’ve created this guide with information about how it works and what it covers.

What is long-term care insurance?

Long-term care insurance gives policyholders a daily amount to cover services associated with assisted living such as bathing, dressing, and eating. The most common providers of these services are home health aides, adult daycares, and nursing homes.

Most Americans over the age of 65 rely on Medicare for their health insurance. Medicare, however, does not pay for custodial care services. Medicaid does, but only impoverished individuals qualify. For those reasons, most people who need long-term care end up funding those costs out of their own pockets. And this is no small expense. Take a look at 2020 median costs for different types of custodial care, projected by insurance company Genworth:

- Adult day care: $1,674 per month

- Home health aide: $4,517 per month

- Assisted living: $4,173 per month

- Semi-private room in a nursing home: $7,738 per month

- Private room in a nursing home: $8,773 per month

As you can see, even a short stint in a nursing home — without the help of long-term health insurance — could quickly undermine your financial situation. Long-term care insurance aims to make these costs more manageable by funding a set daily or monthly amount for medically necessary, custodial care services.

Cost of long-term care insurance

As is often the case with insurance, the more robust the coverage, the higher the premiums. Custodial care is expensive, and that makes long-term care insurance expensive, too. According to The Senior List, you can expect to pay anywhere from $79 to $533 per month in premiums for long-term care insurance. Premiums vary based on your age, gender, health, and marital status.

That number doesn’t mean much until you know what you get in return for those premiums. Your long-term care policy gives you access to a “pool of benefits,” also referred to as the lifetime benefit.

What’s the “pool of benefits” in long-term care insurance?

The pool of benefits on a long-term care policy is the amount the insurer will pay out on your behalf. It’s a function of two other values defined in your policy: the daily/monthly benefit and the benefit period.

- Daily or monthly benefit. This is the maximum the insurer will pay for covered services, expressed as a daily or monthly value. Say you have long-term care insurance with a daily benefit of $150. If your private nursing home room costs $300 per day, you can tap the insurance for $150 and you’d pay the rest.

- Benefit period. The benefit period is the duration of time your insurer will pay your daily or monthly benefit. A policy with a three-year benefit pays out the daily benefit for 1,095 days. Once you use those days, you no longer have coverage. Also, you don’t have to use your benefit period consecutively. Let’s say you use 30 days in 2023 due to an injury. You’d then have 1,065 days left, which you could use next week or 20 years from now — as long as you keep paying your premiums.

The pool of benefits is calculated as your daily benefit, multiplied by the number of days in your benefit period. For example, let’s take a policy with a daily benefit of $150 and a benefit period of three years. Multiply the $150 by 1,095 days, and that translates to an initial pool of benefits of $164,000.

As you’d expect, the daily benefit value and the benefit period both influence the premiums. A higher daily benefit or longer benefit period will cost you more.

What other coverage options impact the cost of long-term care insurance?

There are two other coverage options that also influence your premiums. These are inflation protection and the waiting period.

- Inflation protection. Inflation protection is a built-in annual increase to your pool of benefits. Returning to our $164,000 policy example, let’s say this insurance has a 3% annual inflation adjustment. After 25 years, that policy’s total benefit would be about $343,380. The inflation adjustment impacts your daily benefit, but not the benefit period.

- Waiting period. The waiting period is the duration you are responsible for your care costs before your insurance kicks in. The waiting period begins when you first need custodial care. For example, say you retain the services of a full-time home health aide on September 1. If your policy’s waiting period is 30 days, you pay 100% of your home health aide’s fees in that first month. You won’t have access to your daily benefit until October. Waiting periods can be zero to 90 days or more. Policies may also define different waiting periods for different types of care. A shorter waiting period usually means a higher premium.

What else impacts the cost of long-term health insurance?

Outside of the coverage options you choose, your demographics also impact the cost of your premiums. Key factors include age, health, gender, and marital status.

- Age. Younger people pay less than older people.

- Health. Sadly, if you’re in poor health today, you may not even be a candidate for coverage. And even if your health is fine today, any family history of chronic health problems will push your premiums higher. The best rates are reserved for healthy, low-risk individuals.

- Gender. Women are more likely than men to need long-term care, so women pay higher premiums.

- Marital status. Married couples pay less for coverage than single people. Couples also have access to policies with a shared benefit pool, meaning one spouse could use the other’s benefits if needed.

Average long-term care insurance premiums

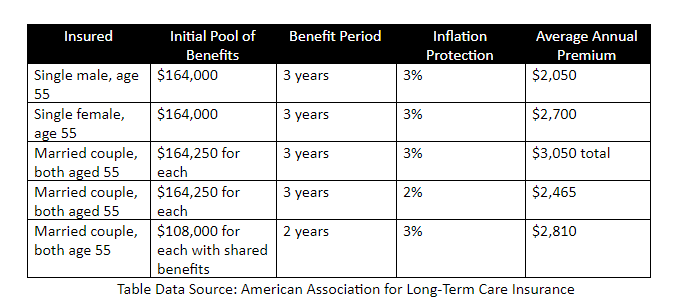

You won’t know how much a long-term care policy will cost you until you get a quote. But a look at average premiums can show you how demographics and different benefit periods impact the rates. The table below shows average policy costs for a single man, single woman, and a married couple with similar coverage levels. These figures are from the 2019 National Long-Term Care Insurance Price Index.

Is long-term care insurance worth it?

Unfortunately, there’s no way to determine definitively that purchasing long-term care insurance will work out in your favor. The biggest unknown in the equation is whether you’ll ever need custodial care. If you don’t, you’ll pay tens of thousands in premiums and never receive a penny back for that investment. One study from AARP reports that 63% of individuals over the age of 65 will have no out-of-pocket expenses for long-term care in their lifetimes. Among those who do need long-term care, 48% need the assistance for less than one year.

So, is long-term care insurance worth it? Only if you use it — which is impossible to predict. That’s not helpful in your analysis, but there is a slightly different question that might get you closer to the right answer. And that’s, “Do I need long-term care insurance?”

Do I need long-term care insurance?

Some people are better candidates for long-term care insurance than others. You can assess your suitability for this coverage by looking at your net worth and your family health history.

- Your net worth. Long-term care insurance protects your savings from getting eaten up by the cost of full-time care. If you have low net worth, you don’t have much in the way of savings to protect. You’d pay for your healthcare until you’re out of money, and then apply for Medicaid. On the other end of the spectrum, if you have very high net worth, you can afford to take the chance that you won’t need custodial care at all. Long-term care insurance makes the most sense for anyone in that middle ground — with, say, a net worth more than $200,000 but less than $1 million. You have savings to protect, but not enough to pay for your care out of pocket.

- Your family health history. If you are predisposed to any chronic diseases or conditions, you’re more likely to use that long-term care benefit. On the other hand, if everyone in your family lives to a hearty 92 without major medical issues, having long-term care coverage makes less sense.

Alternatives to long-term care insurance

Finally, you should know that long-term care insurance isn’t the only way to hedge against future custodial care bills. There are other options. They’re not substantially less expensive, but the best choices return value back to you if it turns out you don’t need custodial care. Here are six alternatives to consider.

1. Life insurance with a long-term care rider

Some permanent life insurance policies offer an optional long-term care rider. This feature allows you to use your death benefit while you are living to cover the costs of long-term care. You can withdraw funds for your custodial care expenses, but those withdrawals immediately reduce your death benefit.

2. Asset-based policy

Asset-based long-term care or ABLTC similarly blends the features of life insurance with long-term care coverage. The premium on an ABLTC policy is often paid in one lump sum. A portion of that premium is invested and earns interest over time, much like the cash value in a permanent life insurance policy. If the time comes when you need assistance with daily living activities, you can “trigger” the long-term care benefit. Any policy value that remains when you die is paid out to your designated beneficiary.

3. Long-term care annuity

A standard annuity is a fixed stream of lifetime payments that you purchase, usually with a lump sum of cash. A long-term care annuity splits your payment stream into two parts: one part you can use for any purpose and a second part that’s earmarked for long-term care expenses. If you don’t use the long-term care portion, you can bequeath it to your loved ones.

4. Self-insure by saving

Rather than paying an insurance company $2,000 for 30 years, you could put that money in a savings or investment account. Or, even better, stash it in a Health Savings Account (HSA) if you qualify. An HSA is an investment account, like a 401(k), available to those who have high-deductible health insurance. Your HSA contributions are pre tax and your withdrawals for medical costs are tax-free.

5. Critical illness insurance

Critical illness insurance pays out a lump sum benefit when you are diagnosed with a qualifying illness. Qualifying illnesses vary by policy, but could include heart attack, cancer, renal failure, or stroke. The benefit amount can range from $10,000 to $50,000, and you can use the cash for any purpose. Check the fine print, though. Some policies will reduce your benefit as you get older — which makes them a poor substitute for long-term care coverage.

6. Life settlement

A life settlement is the sale of your life insurance policy to a third-party through a reputable settlement company like Harbor Life Settlements. The advantage of executing a life settlement is the cash you can generate — typically, you’d sell the policy for more than its cash value. If you have permanent life insurance that you’ve paid into for decades, your backup plan for long-term care expenses could be to sell that policy. And if it turns out you don’t need long-term care, then you can leave the policy and its death benefit in force.

The final word on long-term care insurance

At the end of the day, you can spend a lot on long-term care insurance and never recoup your investment. In truth, most people are better off exploring other, more flexible options to cover the costs of custodial care. From a financial perspective, self-insurance makes the most sense, because you avoid the fees embedded in insurance policies and annuities. Unfortunately, that’s not a good option unless you have the discipline to save several thousand dollars each year to your designated healthcare fund. Not everyone has that discipline. If you don’t, the next best alternative is usually a hybrid life insurance policy that allows for withdrawals to cover long term care expenses.

Jokes aside, purchasing long-term care insurance is a huge financial commitment. Consult a financial advisor or wealth manager on how long-term care coverage options fit into your overall financial plan and goals.