According to Genworth’s annual Cost of Care Report, the average cost of care at an assisted living facility was $5,350 per month in 2023. Adding up to $64,200 a year, assisted living can be hard to afford at its current rate, but even more difficult when considering that costs have gone up by an average of 3.51% annually since 2013.

Even with adequate retirement savings, you may find it difficult to pay for assisted living costs and seek solutions from the government. Luckily, Medicaid offers benefits to help pay for assisted living costs in most states. In this guide, we’ll discuss what Medicaid generally covers and state specific benefits and programs.

What Medicaid Covers for Assisted Living

Medicaid covers some costs of assisted living, but coverage will vary depending on the state where the individual lives because each state has its own rules and regulations. Currently, 46 states offer some form of Medicaid coverage to pay for assisted living costs.

In general, Medicaid may cover assisted living costs including:

- Long-term care provided by an assisted living facility, nursing home, or home health

- Occupational, speech, and physical therapy

- Inpatient and outpatient services

- Prescription drugs

- Personal care services

- Hospice

- Eyeglasses and hearing aids

- Co-pays for hospitalization and skilled nursing care

- Transportation

- Personal emergency response systems

- Case management

The federal government does not permit states to pay assisted living costs related to room and board, but states may use alternative means to make these costs more affordable such as imposing limits on how much communities can charge or providing Supplemental Social Security Income (SSI). However, not all assisted living communities accept Medicaid and most states limit waivers available for seniors, so you shouldn’t rely on it as your only means to pay for care.

How to Apply for Medicaid

You can apply for Medicaid through your state’s agency, but must be a resident of the state where you are applying for benefits. Alternatively, you can also create an account with the Health Insurance Marketplace and complete an application online.

In order to get benefits from Medicaid, you need to meet the eligibility requirements which are based on asset limits. Limits will vary depending on the state you live in, but in 2025 eligible individuals must generally not have a monthly income higher than $2,901 in most states. Assets are included when calculating income limits, so some individuals may consider resorting to spending down in order to meet the requirements. Other eligibility factors include your age, the number of people in your family, and if you are pregnant or have a disability.

For assistance applying for Medicaid, you can contact your local Medicaid office or work with an elder law attorney. If you aren’t eligible initially, you may be given guidance to help you meet the requirements on your next application.

What assisted living facilities accept Medicaid?

Not all assisted living communities accept Medicaid, so you’ll want to check with the community prior to signing an agreement. For help finding a community that accepts Medicaid in your area, you can contact your local Medicaid office or social security agency.

Do Medicaid’s assisted living benefits differ from Medicare?

Medicare will not pay for assisted living costs, only eligible short-term stays in a skilled nursing facility. To cover long-term assisted living costs, you’ll need to rely on Medicaid, veterans’ benefits, pay out of pocket, or use long-term care insurance if you have a policy.

Assisted Living Medicaid Benefits and Costs by State

Medicaid is jointly funded by states and the federal government, and each state has its own programs and waivers to help pay for assisted living costs. For information about how much you can expect to pay for assisted living and the Medicaid benefits available to you, find the state you live in below to learn more. Information on the average cost of assisted living by state is from Genworth’s 2023 Cost of Care Survey while state Medicaid benefits and HCBS Waiver details are cited individually.

Alabama

The average cost of assisted living in Alabama is $4,143 per month, and the state does not provide financial support to help individuals pay for assisted living costs. However, the state offers several programs to help individuals remain in their current homes.

The Alabama Elderly and Disabled Medicaid Waiver provides services to help individuals who need nursing home level care to remain in their home. The State of Alabama Independent Living (SAIL) Medicaid Waiver helps individuals move back or remain living in their homes or communities instead of a skilled nursing facility. The Alabama Community Transition (ACT) Medicaid Waiver has a similar purpose as the SAIL Waiver, but offers services including adult day health, personal care, homemaker services, meal delivery, and home modifications. Finally, the Personal Choices (PC) Program enables seniors participating in one of the programs above to choose and manage their own care provider.

Alaska

In Alaska, the average cost of assisted living is $7,250 per month, and the state will pay for assisted living costs through the Alaskans Living Independently (ALI) Waiver and the Adults with Physical & Developmental Disabilities (APDD) Waiver. These waivers will help cover costs related to adult day care, respite care, home modifications, meal delivery, and medical equipment.

Arizona

On average, the cost of assisted living in Arizona is $5,500 per month. The state will help individuals who are 65 or older pay for assisted living costs through the Arizona Long Term Care System (ALTCS). Alternatively, citizens can use the Self-Directed Attendant Care (SDAC) or Agency with Choice (AWC) programs for assistance with hiring and training a personal caregiver.

Arkansas

Arkansas residents will pay an average of $4,146 per month for assisted living costs. However, the state offers two options to help cover these expenses. The Living Choices Assisted Living Waiver (ALW) covers the costs of care services at an assisted living facility, but will not pay for room and board. Residents can also get assistance through the Personal Care Program, DAAS ElderChoices Waiver, AR Choices in Homecare, or Independent Choices Program.

California

The average cost of assisted living in California is $6,250 per month, but the state will help pay for care through the Medi-Cal program. Through Medi-Cal, Californians can get help paying for assisted living costs through the Assisted Living Waiver (ALW), which covers supportive services such as personal care assistance, medication administration, and meal preparation. The program is limited to 15 counties in the state, but residents can move to an assisted living facility in one of the eligible counties to qualify.

Alternatively, Californians can use the Multipurpose Senior Services Program (MSSP) Waiver or Home and Community-Based Alternatives (HCBA) Waiver to cover supportive care costs while remaining in their home. For residents looking for help with adult day care costs, the Community Based Adult Services (CBAS) program provides support.

Colorado

In Colorado, residents will pay an average of $5,073 per month, and the state will help pay for assisted living costs through several programs including the Elderly, Blind, and Disabled (EBD) Waiver which helps with care costs at an assisted living facility. Additionally, the EDB program has an option called the Consumer Directed Attendant Support Services (CDASS) which provides seniors with more flexibility when choosing a care provider.

Connecticut

The average cost of assisted living services in Connecticut is $4,776 per month and the state offers Medicaid assistance through its HUSKY Health program. The state provides limited personal care at home which can be self-directed.

The state offers the Community First Choice (CFC) State Plan Option, which also helps residents remain living in their homes instead of going to an assisted living facility. Furthermore, the state offers HCBS Medicaid waivers including the Personal Care Assistance (PCA) program to help provide care related to activities of daily living, the Assisted Living program (to give care in assisted living residencies, and the Adult Family Living (AFL) program to provide financial assistance so seniors can remain living at home.

Delaware

The average cost of assisted living in Delaware is $7,425 per month, and residents can get financial assistance through the Diamond State Health Plan Plus (DSHP-Plus). Through the plan, seniors can get help paying for assisted living costs including attendant care, adult day care, home modifications, personal emergency response systems, and hospice care.

District of Columbia (D.C.)

On average, the cost of assisted living in the District of Columbia is $7,348 per month. The state offers the Elderly and Persons with Physical Disabilities (EPD) Medicaid Waiver program, which is designed to help residents continue living at their home or at an assisted living facility instead of a nursing home. The program also allows for self-direcred care or for family members to be hired as caregivers.

Florida

In Florida, the average monthly cost of assisted living is $4,750. Florida previously used HCBS waivers to help with assisted living costs, but now provides financial assistance through the Statewide Medicaid Managed Care Long-Term Care Program (SMMC LTC). The program provides a broad range of care and non-care support services including personal care assistance, home-delivered meals, respite care, home modifications, and others.

Georgia

The average cost of assisted living services in Georgia is $4,120 per month, and the state offers two Medicaid programs to help with assisted living expenses. The Community Care Services Program (CCSP) provides support to help residents remain independent, while the Service Options Using Resources in a Community Environment (SOURCE) waiver is intended for individuals who require a higher level of medical care and are unable to live independently.

Hawaii

Hawaiian residents will pay an average of $9,340 per month for assisted living services. Unlike most states, Hawaii does not use Medicaid waivers with enrollment caps. Instead, the state uses a program called Med-QUEST to provide benefits including assisted living, adult day care, home health services, personal emergency response systems, and others. Hawaii also offers a Community Care Foster Family Homes (CCFFH) program that provides adult foster care services.

Idaho

In Idaho, the average cost of assisted living services is $5,000 per month, and the state provides three support programs to help with these expenses. The HCBS Aged & Disabled Medicaid Waiver (A&D) pays for a variety of services at an individual’s home, assisted living facility, or adult foster care in order to prevent nursing home placement. The Personal Care Services Program (PCSP) is intended for elderly and disabled residents and provides assistance for activities related to living at home like bathing, meal preparation, housecleaning, and grocery shopping. Finally, the Medicare Medicaid Coordinated Plan (MMCP) helps to coordinate benefits between Medicaid and Medicare such as medical, behavioral health, dental, prescription drugs, and long-term care services.

Illinois

The average cost of assisted living services in Illinois is $5,225 per month and the state provides two Medicaid programs to help with these expenses. HealthChoice Illinois provides long-term care services and assistance with activities of daily living like bathing, grooming, dressing, and others. The Illinois Medicare-Medicare Alignment Initiative (MMAI) helps disabled individuals and seniors who receive Medicaid and Medicare benefits by streamlining services from both programs into a single plan that includes adult day care, personal care assistance, personal emergency response systems, and others.

Indiana

Indiana residents pay an average of $5,013 per month for assisted living services. The state offers a Home and Community Based Services (HCBS) Medicaid Waiver for individuals who require nursing home level care, but would prefer to stay at home. Additionally, Indiana has an Aged and Disabled (A&D) Medicaid Waiver program that provides assistance for individuals living at home, in foster homes, or at an assisted living facility. The program also helps people who are currently living in a nursing home but want to return home. Under this waiver program, there is a Structured Family Caregiving benefit that provides a caregiver to the elderly or disabled individual.

Iowa

The average cost of assisted living services in Iowa is $5,200 per month, and the state offers two programs to help residents self-direct their care. The Home and Community-Based Services (HCBS) Waiver provides in-home care that is equivalent to what is available in a nursing home. Through the program, individuals can choose which services they want and who to hire as their caregiver. Alternatively, the Health and Disability Waiver is available for physically disabled individuals who are under 65 and allows people to choose their care worker.

Kansas

In Kansas, the average cost of assisted living services is $5,850 per month and the state provides assistance through its Medicaid program called KanCare. KanCare will pay for nursing home care in addition to some in-home personal care services. Alternatively, the state also has a Frail Elderly (FE) Waiver that is intended specifically for the elderly with the purpose of preventing or delaying unnecessary nursing home placement. Through the waiver, residents can receive services including adult day care, personal emergency response systems, assistive technology, medication reminders, assisted living care services, and attendant care.

Kentucky

Kentucky residents can expect to spend $4,335 per month on assisted living costs based on the average across the state. Kentucky offers Home and Community Based Services (HCBS) Waivers to provide long-term care support including home modifications, personal care assistance, adult day care, homemaker services, and respite care. Alternatively, the state also offers the Supports for Community Living (SCL) Waiver for individuals who are intellectually or developmentally disabled. The waiver offers similar benefits as the HCBS waiver, along with other psychological services and specialized medical equipment.

Louisiana

On average, the cost of assisted living services in Louisiana is $4,750 per month. Louisiana does not currently provide financial assistance to help pay for assisted living expenses. However, the state offers several alternative programs including the Adult Day Health Care (ADHC) Medicaid Waiver to provide adult day care services for seniors and individuals who require nursing home level care. Additionally, the state offers the Community Choices Waiver (CCW) that provides support services to prevent and delay nursing home placement.

Maine

The average cost of assisted living services in Maine is $8,712 per month. Maine does not provide support for individuals living in assisted living facilities, but provides two options to help residents remain living in their homes. Through the state’s Medicaid program known as MaineCare, residents have access to the MainCare Consumer Directed Attendant Services (CDAS) program that allows eligible individuals to hire a personal caregiver of their choice for in-home care. Maine also offers the Elderly and Adults with Disabilities Waiver which provides services including personal care assistance, home delivered meals, home modifications, and non-emergency transport.

Maryland

On average, the cost of assisted living services in Maryland is $6,900 per month. Maryland features several Medicaid programs to help with assisted living expenses, including the Community Personal Assistance Services (CPAS) program for individuals who need help with activities of daily living and the Community First Choice (CFC) program that provides care services for elderly individuals in their homes and adult foster care homes. Alternatively, residents also have access to four HCBS Waivers.

The Community Options (CO) Waiver provides benefits for individuals who need nursing home level care, and is available for residents in their home or assisted living communities. The Community Pathways Medicaid Waiver provides support to individuals who have an intellectual or developmental chronic disability. The Medical Day Care Services Waiver provides daytime supervision and care for individuals at risk of nursing home placement. Finally, the Increased Community Services (ICS) Waiver is designed for frail elderly or physically disabled individuals who live in a nursing home, but wish to move back to their home or an assisted living facility.

Massachusetts

In Massachusetts, the average cost of assisted living is $7,120 per month and the state provides support through its Medicaid program called MassHealth. The state offers four programs to help with assisted living costs, including the Personal Care Attendant (PCA) program which provides self-directed personal care services for elderly and disabled individuals. Additionally, the state offers the Caregiver Homes program which offers financial assistance to caregivers providing 24-hour care for an elder.

There’s also the Group Adult Foster Care (GAFC) and Supplemental Security Income (SSI-G) Assisted Living Benefit that covers assisted living and home-care costs so residents don’t have to live in a nursing home. Finally, the Adult Day Health (ADH) program provides daytime support for seniors.

Michigan

Michigan residents pay an average of $5,050 per month for assisted living services. The state offers the Michigan Home Help Program as part of its state Medicaid program, which provides personal care assistance in an individual’s home including services such as bathing, dressing, eating, cleaning, and other activities of daily living. The state will also pay for medical and non-medical assisted living costs through the MI Choice Waiver Program or the Health Link Program.

Minnesota

The average cost of assisted living services in Minnesota is $5,350 per month, aligning with the national average. Residents can receive help paying for these expenses through the Elderly Waiver (EW) intended for individuals who require nursing home level care, but wish to remain living in their current community. Alternatively, the Community Access for Disability Inclusion (CADI) Waiver provides support for nursing services and personal assistance for disabled individuals under the age of 65. Finally, the PCA program helps seniors self-direct their care so they can hire a caregiver of their choosing.

Mississippi

The average cost of assisted living services in Mississippi is $3,800 per month and the state offers three Medicaid programs to help pay for these expenses. The Assisted Living (AL) Waiver provides personal care services for individuals in an assisted living community to help them live independently. The Independent Living (IL) Waiver is intended for individuals with neurological or orthopedic impairments and provides a variety of support services for eligible individuals. Finally, the Elderly and Disabled (E&D) Waiver helps individuals who would otherwise require nursing home placement, live independently through support services like adult day care, meal delivery, and help with activities of daily living.

Missouri

In Missouri, the average cost of assisted living services is $4,851 per month. Medicaid assistance through its program called MO HealthNet. The Missouri state plan covers the cost of nursing home care along with some home and community based services through smaller programs like the Missouri Care Options (MCO) program. The state also offers HCBS waivers including the Aged and Disabled Waiver (ADW) to provide in-home services, the Supplemental Nursing Care (SNC) to provide financial assistance with assisted living facility costs, and the Independent Living Waiver (ILW) to provide self-directed care and medical supplies.

Montana

In Montana, the average cost of assisted living services is $4,908 per month. Residents can receive support for services that help with activities of daily living through the Community First Choice (CFC) program and disabled individuals can get assistance through the Big Sky Home and Community Based Services Program.

Nebraska

Nebraska residents can expect to pay an average of $5,399 per month for assisted living services. The state offers the Personal Assistance Services (PAS) program for individuals with a chronic disability who require consistent care in an assisted living facility. Additionally, Nebraska offers the Aged and Disabled Medicaid Waiver which is designed to help elderly individuals age in place, either at home or at an assisted living facility.

Nevada

In Nevada, the average cost of assisted living services is $5,000 per month and the state has a Long-Term Services and Support (LTSS) unit that provides ongoing care for elderly and disabled individuals through Medicaid. Nevada has a Personal Care Services (PCS) program that is intended to delay or prevent nursing home placement by providing supportive services related to activities of daily living. Additionally, the state offers the Home and Community Based Waiver for frail, elderly individuals who require non-medical assistance in their place of residence. Finally, the Home and Community Based Waiver (HCBW) for Persons with Physical Disabilities provides support benefits that help disabled individuals remain living in their current community instead of moving to a new nursing home.

New Hampshire

The average cost of assisted living services in New Hampshire is $7,025 per month. New Hampshire provides residents with the Personal Care Attendant Services (PCAS) program, which is intended to prevent premature nursing placements for physically disabled residents who are 80% wheelchair-bound. The program provides supportive services including help with activities of daily living like mobility, bathing, hygiene, and grocery shopping. Residents also have access to the Choices for Independence Waiver, which provides assisted living services for individuals who require nursing home level care.

New Jersey

On average, New Jersey residents pay $7,400 per month for assisted living services. The state has a Medicaid Managed Long Term Services and Supports (MLTSS) system that provides a variety of services for several types of care including in-home, assisted living facility, adult foster care, and adult day care. Individuals can also enroll in the Personal Preference Program to self-direct their own care, including a cash allowance that allows people to choose as they see fit for their personal requirements.

New Mexico

In New Mexico, the average cost of assisted living services is $5,450 per month and the state offers financial support through their Medicaid program known as Centennial Care. The Centennial Care Community Benefit provides self-directed care and support services to assist seniors aging in place.

New York

New Yorkers will pay $5,850 per month for assisted living services based on average costs across the state. New York’s Community First Choice State Plan Option (CFCO) provides at-home personal care assistance for seniors who require nursing level care. Additionally, the state offers the Managed Long Term Care Program (MLTC), Consumer-Directed Personal Assistance Program (CDPAP), and Assisted Living Program (ALP) to provide at-home or assisted living support services for eligible individuals.

North Carolina

In North Carolina, the average cost of assisted living services is $5,769 per month. The state offers a Personal Care Services Program to provide assistance with activities of daily living in an individual’s home or residential care. Additionally, the state also offers the Community Alternatives Program for Disabled Adults (CAP/DA) which provides personal care and homemaker services in an individual’s home.

North Dakota

The average cost of assisted living services in North Dakota is $5,050 per month. The state offers the Medicaid State Plan Personal Care Services program, which provides financial assistance to pay for care services in a resident’s home, assisted living facility, adult day care, or foster adult care.

Ohio

On average, Ohio residents will pay $5,294 for assisted living services and the state offers three programs to help with these expenses. The PASSPORT Waiver provides home-based care for individuals who would otherwise need to live in a nursing home. The Assisted Living Waiver helps pay for some of the costs associated with an assisted living facility. Finally, the MyCare Ohio Plan (MCOP) provides a single point of contact for individuals who utilize Medicare and Medicaid benefits.

Oklahoma

The average cost of assisted living services in Oklahoma is $4,888 per month and the state provides two programs to help cover these expenses. The Personal Care Program is an entitlement program that provides financial assistance so elderly and disabled individuals can hire a personal caregiver. The Advantage Program Waiver provides seniors with support services at home or at an assisted living facility.

Oregon

In Oregon, the average cost of assisted living services is $5,825 per month and the state provides assistance through its Medicaid system known as the Oregon Health Plan (OHP). Under the state’s plan, residents have access to the Oregon K Plan ( also known as the Community First Choice (CFC) plan) which provides long-term support for eligible individuals in their home or in a community. Additionally, the state also provides the Independent Choices Program (ICP) which provides monthly cash payments to help individuals pay for their own care. The money usually goes towards assistive technology and personal care services.

Oregon also offers HCBS Waivers to help pay for assisted living costs, including the Aged and Physically Disabled (APD) Waiver, Client-Employed Provider (CEP) program, and Oregon Spousal Pay Program that provides payment to spouses who act as a caregivers.

Pennsylvania

Pennsylvania residents will pay an average of $5,550 per month for assisted living services. The state offers the Community Health Choices (CHC) program that offers a wide array of services to help individuals remain at home instead of moving to a nursing home. Additionally, the Services My Way (SMW) program gives beneficiaries flexibility to determine their own care requirements and select the services they require.

Rhode Island

In Rhode Island, the average cost of assisted living services is $5,830. Rhode Island is unique because the state plan and Medicaid Waivers are merged under the Rhode Island Global Consumer Choice Compact Waiver which provides several services including personal care, homemaker services, adult day care, respite care, meal delivery, home modifications, and skilled nursing. The waiver also allows for self-direction, so residents can choose their own caregiver.

South Carolina

The average cost of assisted living services in South Carolina is $4,650 per month and the state offers two waivers to help pay for these expenses through its program Health Connections. The Community Choices Waiver provides a variety of support services to help residents remain in their homes instead of moving to a nursing home, while the Community Supports Waiver provides similar services but is intended specifically for individuals who are intellectually impaired.

South Dakota

The average cost of assisted living in South Dakota is $5,341 per month, just below the national average. The state’s Personal Care Services Program provides in-home services to prevent or delay nursing home placement, while the HOPE Waiver provides personal care assistance at home or in an assisted living facility.

Tennessee

In Tennessee, the average cost of assisted living services is $4,900 per month and the state provides support through its Medicaid program known as TennCare. Tennessee offers only one waiver to help the elderly pay for assisted living costs, the TennCare CHOICES in Long-Term Care Program. The program provides nursing home services and assists seniors who require nursing home care by providing benefits including personal care, homemaker services, meal delivery, respite care, adult day care, and home modifications.

Texas

Texans who need assisted living services will pay an average of $4,915 per month. The state offers support through its STAR+PLUS Waiver, which offers a range of services including personal care, adult day care, and meal delivery among others for elderly individuals. The goal of the waiver is to help seniors remain in their homes instead of making them move to a nursing home. The STAR+PLUS Waiver also includes services that were previously available through the Primary Home Care Program, Community Based Alternatives Waiver, and Day Activity and Health Services.

Outside of the STAR+PLUS Waiver, residents also have access to Community Attendant Services (CAS) which provides non-medical personal care to individuals in their homes. Additionally, residents can also receive benefits from the Community First Choice (CFC) program that offers assistive services related to activities of daily living.

Utah

The average cost of assisted living services in Utah is $4,150 per month and offers support through its Personal Care Services program. Furthermore, Utah also offers two HCBS Waivers. The Aging Waiver is for individuals 65 or older and it provides care services to support independent living. The New Choices Waiver (NCW) is the other option, which offers transitional services to help seniors move from a nursing home or assisted living facility back to a residential community.

Vermont

On average, Vermont residents who require assisted living services will spend $8,635 per month and the state offers assistance through its Medicaid program known as the Global Commitment to Health Waiver. Through the state’s Medicaid program, residents can get help covering assisted living costs through five programs.

The Assistive Community Care Services (ACCS) Program provides personal care to delay or prevent nursing home placement. The Attendant Services Program (ASP) provides support services to assist with personal care services related to activities of daily living. The Adult Day Services Program provides seniors with access to adult day care. The High Technology Home Care Program provides skilled nursing services and case management for elderly or disabled residents who require medical technology. Finally, the Choices for Care (CFC) Waiver provides long-term care services for seniors in their home, assisted living facilities, or adult foster care homes.

Virginia

In Virginia, the average cost of assisted living services is $6,050 per month and the state offers one waiver to help with these costs. The Commonwealth Coordinated Care Plus Medicaid Waiver (CCC+) combines two older waivers to provide independent living services for seniors and disabled individuals who require a nursing home level of care but wish to remain living at home. The option is self-directed, so individuals can hire their own caregiver.

Washington

The average cost of assisted living services in Washington is $6,138 per month, and the state offers several assistance options through its Medicaid program known as Washington Apple Health.

The state’s Medicaid Personal Care Plan (MPC) offers elderly and disabled individuals assistance with activities of daily living. The Community First Choice Option (CFCO) provides support services for individuals who require an institutional level of care. The state also offers the Nurse Delegation Program, which provides Medicare care services such as tube feedings and daily injections. Furthermore, the state also offers a program called Medicaid Alternative Care (MAC), which provides support for unpaid caregivers of seniors.

Beyond these options, the state also offers HCBS Waivers including the Washington Medicaid COPES Waiver and New Freedom Medicaid Waiver which help eligible residents remain living at home.

West Virginia

In West Virginia, the average cost of assisted living services is $5,500 per month and the state provides assistance through the Medicaid Personal Care Program. This program offers personal care services to help eligible individuals with activities of daily living including bathing, dressing, eating, cleaning, mobility, and medication monitoring. Furthermore, the state also offers the West Virginia Aged and Disabled Waiver (ADW) to help seniors and disabled individuals age in place.

Wisconsin

Wisconsin residents who require assisted living services will spend an average of $5,500 per month. The state provides the Medical Assistance Personal Care (MAPC) program, which offers services to help with activities of daily living. Additionally, residents have access to Family Care and Family Care Partnership Programs that provide long-term care support to help seniors continue living in their homes.

Wyoming

In Wyoming, the average cost of assisted living services is $5,730 per month and the state offers one Medicaid Waiver to help with these expenses. The Community Choices Home and Community Based Services Medicaid Waiver (CCW) provides support services to help Wyoming residents continue living at home, in the home of a relative, or at an assisted living facility instead of a nursing home. Services provided through the program include adult day care, meal delivery, respite care, transportation, and other benefits.

How to Find an Assisted Living Community that Accepts Medicaid

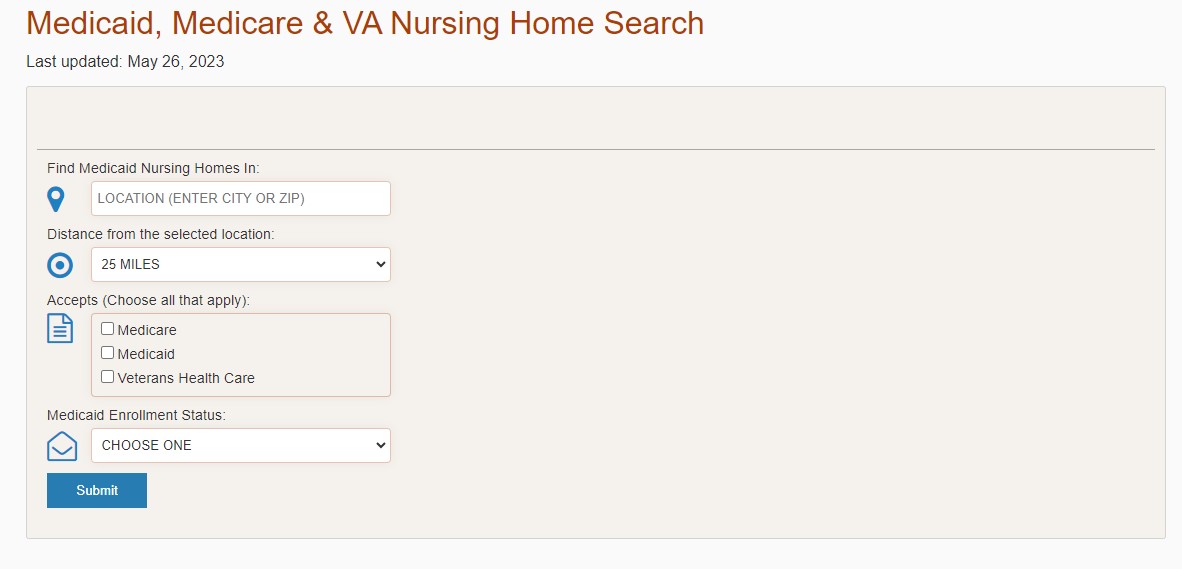

Not every assisted living facility accepts Medicaid, so if you plan on using benefits to pay, you’ll need to check when researching communities. You can find nearby facilities that accept Medicaid using the American Council on Aging’s free tool. The tool allows you to add your location, set a distance from that location, and filter by Medicaid, Medicare, and VA Benefits:

After using the tool to find options, you can set up tours. When visiting, make sure to ask lots of questions. If you’re not sure what’s important, you can use our cheat-sheet of questions to cover the essential information at each facility. Finally, after choosing a facility, it’s a good idea to talk with a financial advisor to help plan how you’ll be paying for assisted living costs. Be aware, accepting Medicaid funds can open the door to a nursing home taking away your house through the Medicaid Estate Recovery Program, so make sure you know what you’re getting into before accepting. If you still don’t have enough funds with your Medicaid benefits, you can look into other options like selling your life insurance.